- Stellar’s network achieves feature complete status, enhancing DeFi and payments.

- Franklin Templeton leverages Stellar for U.S. Treasuries tokenization and cost savings.

- Denelle Dixon focuses on global scaling to expand financial access worldwide.

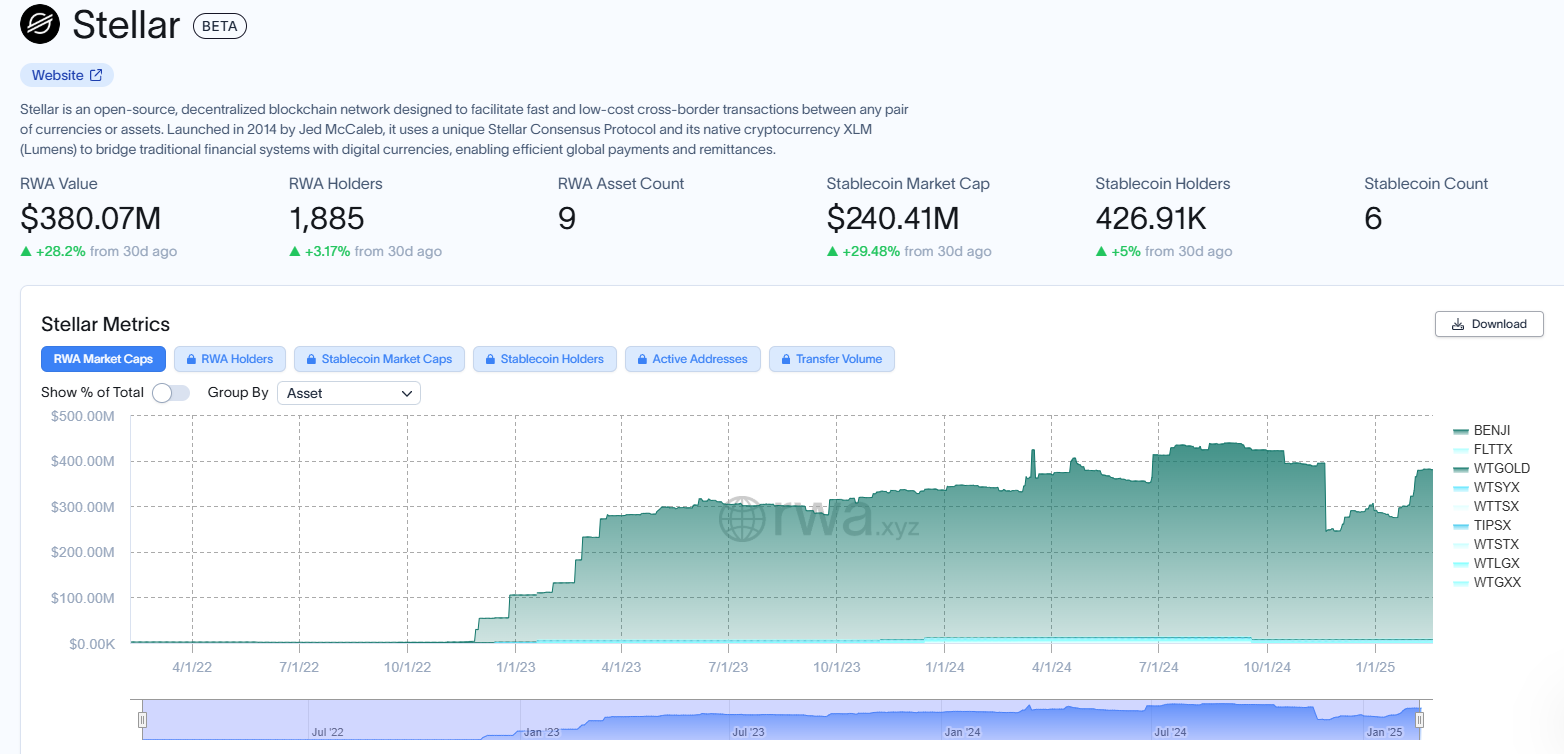

The Stellar Development Foundation (SDF) has declared the Stellar network “feature complete,” a significant milestone in the mission to transform the world of finance. After 10 years of focused development, the network can now support decentralized finance (DeFi), cross-border payments, and real-world asset (RWA) tokenization. This sets the stage for Stellar’s global expansion.

Denelle Dixon, CEO and Executive Director of the SDF said: “When we started, many thought blockchain was just for faster payments. We built a foundation that institutions and developers can rely on. Now it’s about scaling this technology to the people who need it most.”

One Platform with Many Use Cases

Stellar now has all the financial applications. Soroban’s innovative contract system is a developer-friendly environment for scalable DeFi solutions. On the payment side, Stellar has over 300,000 global cash-to-crypto on and off-ramps for quick and low-cost cross-border transactions.

Another key feature is the tokenization of real-world assets. Issuers can approve, revoke, or freeze tokens, so security and regulatory compliance are built in. This has given institutions confidence in the technology.

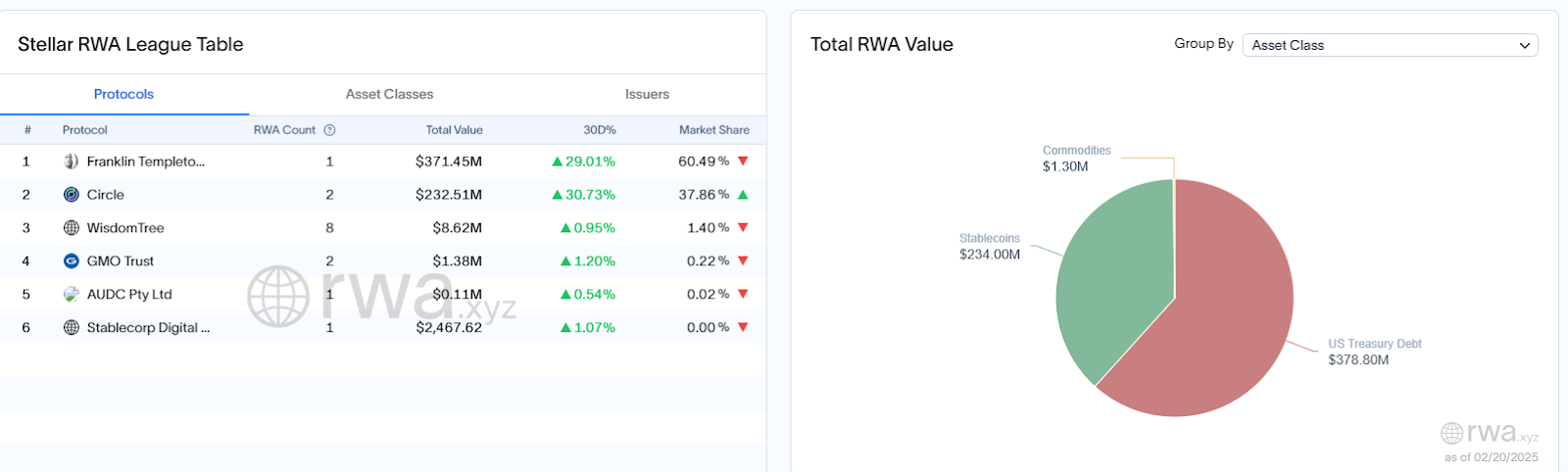

Institutional adoption has been a big part of Stellar’s growth. Franklin Templeton uses the network to tokenize US Treasuries, streamlining traditional financial processes. Their $593m on-chain US Government Money Fund has $372.5m allocated to Stellar’s blockchain. This is a big deal for the network’s ability to manage significant assets.

Recent numbers show Stellar’s TVL in RWAs is up 37.5% in the last month to $380.07M. This has grown its RWA market share to 5.15% as institutional players become more comfortable.

Scaling for Global Financial Inclusion

With the feature complete, Stellar is now scaling. Dixon said the focus is on reaching underserved regions without access to financial services. “It’s not about adding more features. It’s about making what we’ve built benefit as many people as possible.”

Stellar’s strengths include low fees, fast transactions, and compliance-ready tools, which make it perfect for institutions looking for cost-effective solutions. Stellar will expand financial access globally through partnerships and applications using its existing infrastructure.