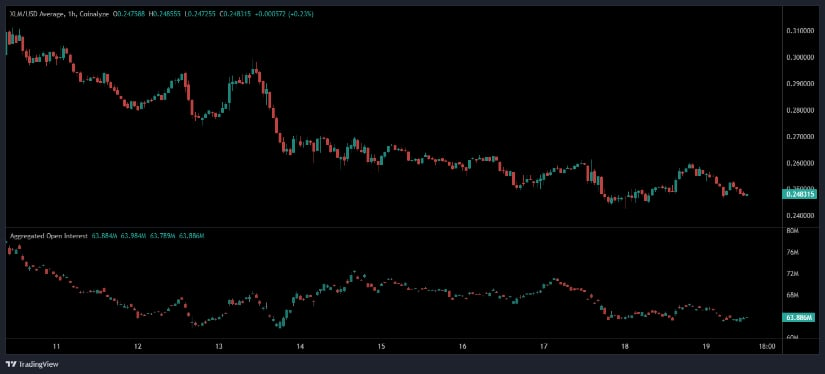

- XLM/USD struggles beneath $0.26 resistance with continued lower highs.

- Stellar’s market sentiment remains weak with open interest at 63.9M.

- XLM’s price is currently stuck near $0.2491 after hitting lows of $0.086.

Stellar (XLM) has continued to face challenges in the market. According to the latest data, the current price stands at $0.2491, showing a slight decrease of 0.23% in the last 24 hours.

However, this move does little to conceal the ongoing downtrend in the market. Sellers remain in control as the price continues to print lower highs and lower lows.

XLM has failed to break through the crucial $0.26 resistance level on multiple occasions, which has kept the price below this key barrier. Attempts to push higher have been quickly rejected, causing the price to stay within a narrow range.

Open interest in XLM derivatives stands at 63.9 million, indicating market activity but not necessarily strong conviction. This lack of a meaningful spike in open interest suggests that the market is hesitant to take aggressive positions, keeping XLM in a state of consolidation.

Stellar’s Volatility Over the Past Year

Over the past year, XLM has experienced significant price volatility. After peaking at $0.785, the price dropped sharply to $0.314 and then further to a low of $0.086. This prolonged downtrend highlights the ongoing weakness in the market.

Currently, key support levels for XLM are at $0.86, $0.314, and $0.245, which are critical for any potential price recovery. These levels may act as important price points for traders to monitor as XLM attempts to stabilize.

Potential for Future Growth

Looking forward, XLM is positioned to potentially benefit from broader trends in digital assets, including the ISO 20022 compliance. This global standard is becoming more widely adopted across the financial industry, and as a fully compliant digital currency, XLM may gain traction as these shifts continue.

However, for now, the market appears cautious, with traders awaiting stronger signals before committing to long-term positions. For now, XLM remains in a precarious position as it continues to navigate a volatile market with limited signs of reversal.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.