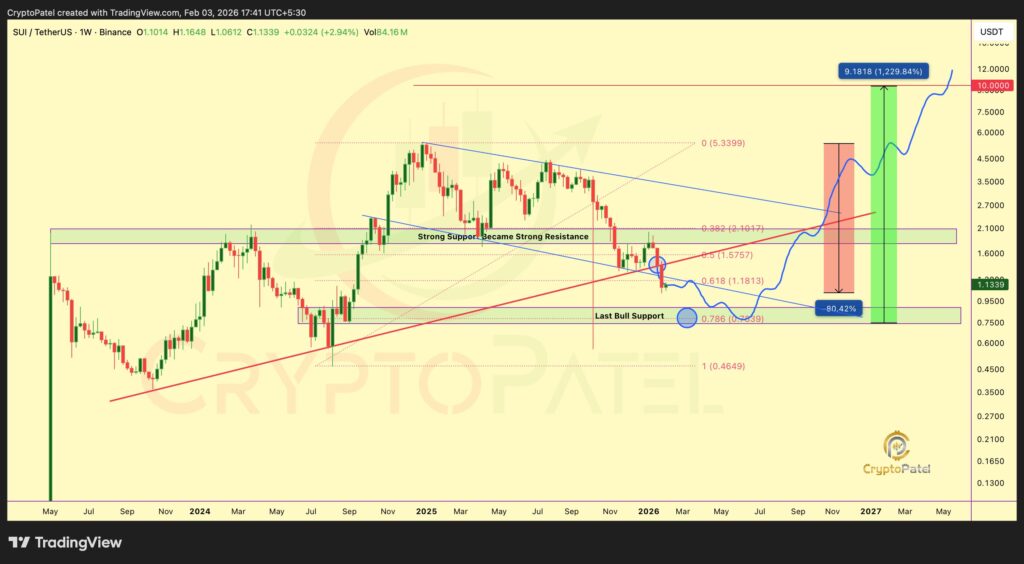

- SUI has dropped 80% from its all-time high, now testing crucial support levels.

- The 0.618-0.786 Fibonacci zone around $0.78 is crucial for a potential rebound.

- A weekly close below $0.78 would invalidate a bullish scenario for SUI.

SUI has seen an alarming 80% drop from its all-time high, leaving many investors wondering about its next move. As it approaches a critical support zone, analysts are closely monitoring key Fibonacci levels. Can SUI hold strong at $0.78, or will it face further declines?

SUI Faces Critical Support After Major 80% Decline

SUI, a cryptocurrency that had seen impressive growth, has recently faced a significant 80% decline from its all-time high of $5.37. The price has now dropped to around $1.10, and the coin is testing crucial support zones.

This significant drop has left many investors questioning whether the cryptocurrency can recover. SUI is now approaching the 0.618 and 0.786 Fibonacci levels, with the $0.78 price point serving as a critical support level for potential recovery. Analyst CryptoPatel has outlined the importance of holding above this level to avoid further declines.

Key Technical Levels and SUI’s Recovery Potential

SUI’s decline broke its long-term ascending trendline, which has made the market more uncertain. The cryptocurrency is now facing strong resistance at $1.57, which was once a major support level. As the price tries to stabilize, it is approaching the 0.618 Fibonacci level at $0.78, where the last bullish structure support exists.

CryptoPatel pointed out that if SUI holds above $0.78, there could be a chance for a strong rebound, potentially reaching the $10 target. However, a close below this key support would invalidate the bullish outlook and indicate further downside potential.

CryptoPatel’s forecast also highlights that the price levels to watch include $1.57, $2.10, and the critical $0.78 support. A weekly close below $0.78 would signal a further decline in price. On the other hand, if the support holds, SUI could see a massive rebound, offering a significant upside potential.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.