- TRON processed at around 687B (57.7) and Ethereum recorded a record of around 504B, reducing the difference by half.

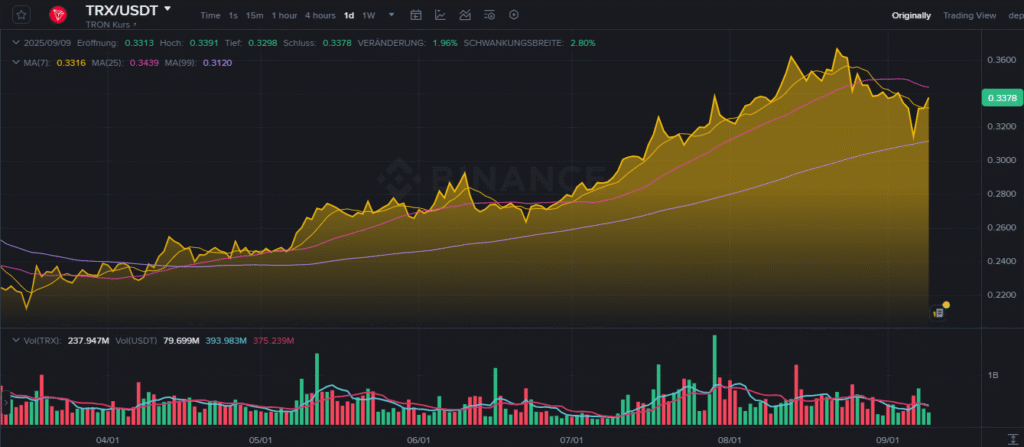

- MA, recapture the 0.3439 to 0.3500 with increasing volume, it would indicate further movements upward to 0.358 to 0.362; supports are 0.332-0.334 and 0.320-0.315.

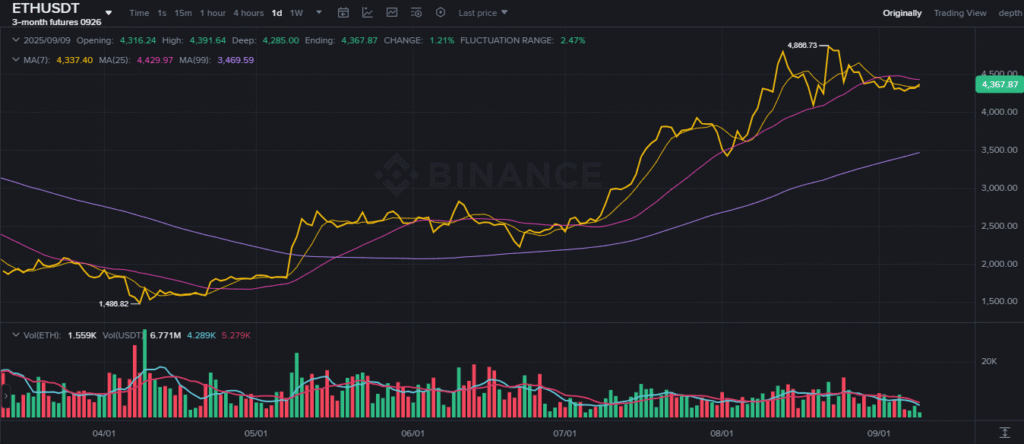

- a break above 4,450 would hit 4,600 and 4,880-4,900, and break below 4,320-4,340 would support.

Stablecoin activity accelerated in August as USDT transfers reached about $1.19 trillion. TRON processed roughly $687 billion, while Ethereum delivered a record $504 billion. TRON held 57.7% share, yet Ethereum narrowed the gap with faster growth.

TRON

TRX continues a steady daily uptrend that began in April and survived a recent pullback. Price ended near 0.3378 after rebounding from last week’s dip. The higher-high, higher-low structure remains intact on the broader timeframe.

Short-term momentum improved as price moved above the 7-day average at 0.3316. However, it trades below the 25-day average near 0.3439, signaling nearby resistance. The 99-day average at 0.3120 slopes higher and anchors trend strength.

Volume expanded during July and August advances and faded on pullbacks. The latest bounce carries modest volume, so follow-through is important. A drive through 0.345–0.350 with stronger activity would support continuation.

Source: Binince

Immediate resistance stands at 0.343–0.350, then 0.358–0.362 at the swing high. Initial support sits at 0.332–0.334, with deeper support at 0.320–0.315. A close under 0.332 would open a retest of the 0.320s.

Ethereum

ETH quarterly futures trade near 4,367 with a mild daily gain. From the April low around 1,489, the price climbed in persistent stair-steps. A peak near 4,887 formed in August, and consolidation followed.

Source: Binince

Price sits above the 7-day average near 4,337 but below the 25-day at 4,430. The 99-day at 3,470 rises steadily, preserving the longer-term uptrend. A recent 7/25 bearish cross explains slower momentum.

The range now spans roughly 4,250 to 4,550 with shallow pullbacks. Volume swelled on summer breakouts but eased during sideways trade. A volume expansion on closes through resistance would signal renewed sponsorship.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.