- VeChain (VET) experiences a 5.32% price drop, trading at $0.01179 amid bearish market conditions.

- Despite new institutional validators, VeChain struggles with price decline, showing oversold conditions on RSI.

- VeChain’s price support is seen around $0.011, as market sentiment remains cautious.

VeChain has announced the addition of Draper Dragon and Fenbushi Capital as institutional validators on the VeChainThor blockchain. This milestone comes at the same time as the full launch of the Hayabusa upgrade.

The decision of these respected venture firms to participate reflects their confidence in VeChain’s enterprise-ready blockchain infrastructure. At press time, VeChain (VET) continues to face downward price pressure, trading at $0.01179, a 5.32% decrease over the past 24 hours.

Validator Participation Enhances Network Security and Trust

Validators play an essential role in blockchain networks by confirming transactions and ensuring network security. VeChain’s validator community now includes 19 participants, thanks to the addition of Draper Dragon and Fenbushi Capital.

Andy Tang, founding partner at Draper Dragon, expressed, “Joining the VeChain Validator Program reflects our confidence in a network built for real economic impact.”

This statement underscores the firm’s belief in VeChain’s potential to deliver scalable and practical solutions at a global scale.

Similarly, Bo Shen from Fenbushi Capital noted, “VeChain continues to demonstrate how blockchain can deliver practical value at global scale,” reaffirming VeChain’s ability to meet the expectations of enterprise and institutional users.

Technical Analysis: VeChain Price Movement and Market Outlook

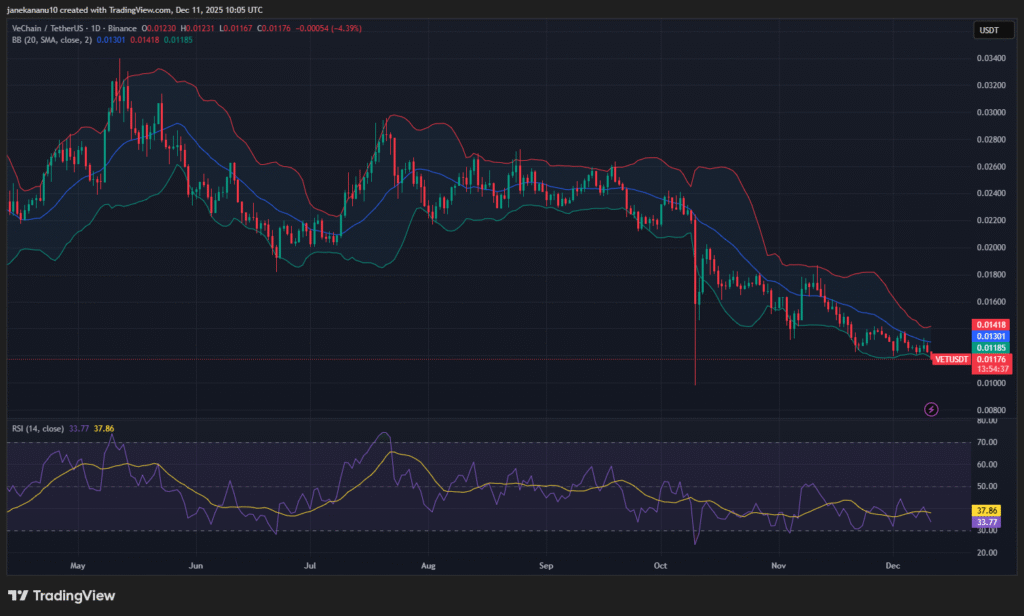

VeChain (VET) shows a bearish trend, trading at $0.01179. The cryptocurrency has seen a 5.32% decline over the past 24 hours. The Bollinger Bands are indicating a narrowing range, which typically suggests a period of low volatility or possible future price movement.

The Relative Strength Index (RSI) is currently at 33.77, suggesting that VET is in the oversold region. This could signal a potential price reversal if buying pressure increases.

However, the overall market sentiment remains bearish, with support levels expected around $0.011. VeChain has seen institutional backing with the addition of Draper Dragon and Fenbushi Capital, but its price remains under pressure.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.