- WLFI’s micro support at $0.1680 is key to its future movement.

- Justin Sun transferred 50M WLFI tokens, raising concerns of mismanagement.

- The market’s uncertainty adds pressure to WLFI’s ongoing price consolidation.

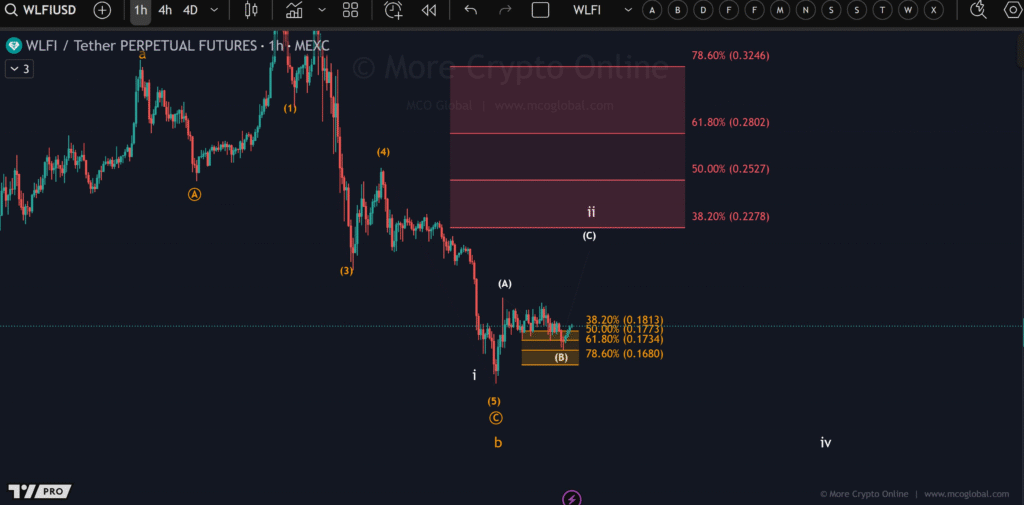

WLFI/Tether (WLFIUSDT) is facing a key test of micro support in the midst of growing market uncertainty. According to recent analysis shared by More Crypto Online, WLFI is consolidating after a sharp decline. Traders focus on price action to determine whether the asset can maintain its position above critical support levels.

Technical Structure and Market Behavior

On the 1-hour chart, WLFI is currently in a corrective structure. Wave counts show that WLFI recently completed wave “i” down, followed by a corrective “(A)-(B)-(C)” formation.

The price movement from this point will likely reveal whether wave ii extends higher or if the asset experiences further downside toward wave iii. Key levels, identified through Fibonacci retracement, play a crucial role in predicting the next stages of price action.

Traders are monitoring whether WLFI can hold above the $0.1680 support. A breakdown below this level could suggest that further downside is likely, leading the asset to test deeper corrective levels.

On the other hand, if WLFI holds above support, a recovery into wave iv may become more likely. For now, the asset remains in a phase of consolidation, with its next move hanging in the balance.

Justin Sun Moves 50M WLFI Tokens Amid Blacklist Concerns

Recent developments surrounding WLFI have raised concerns within the community after Justin Sun moved 50 million WLFI tokens. These tokens were initially transferred from a wallet labeled “0x5AB,” which had been blacklisted by the WLFI team.

This wallet was linked to Sun and had been flagged for suspected misappropriation of funds. The transfer of these tokens to a new wallet, “0xBDF,” triggered further scrutiny from the WLFI team.

Within the past 24 hours, the same 50 million WLFI tokens were moved again, this time from “0xBDF” to “0x005D,” and then to the HTX hot wallet “0xA03.” As a result, there has been increased concern about the management of WLFI tokens and whether the WLFI team will take action to recover the funds.

The movement of these tokens has prompted questions regarding the security and handling of community assets. The WLFI team has not yet made any public statements on the matter, leaving the community to wonder what steps will be taken next.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.