- WLFI shot to $0.2339 and then to $0.2108, which is a sign of a serious fight between bulls and bears.

- The selling force was the spot markets and the inflows of the derivatives and funding rates were high and indicated the conviction of the long side strongly.

- The trading volume increased 60.39 percent to 1.37B indicating high turnover even though it recorded steady declines across various periods.

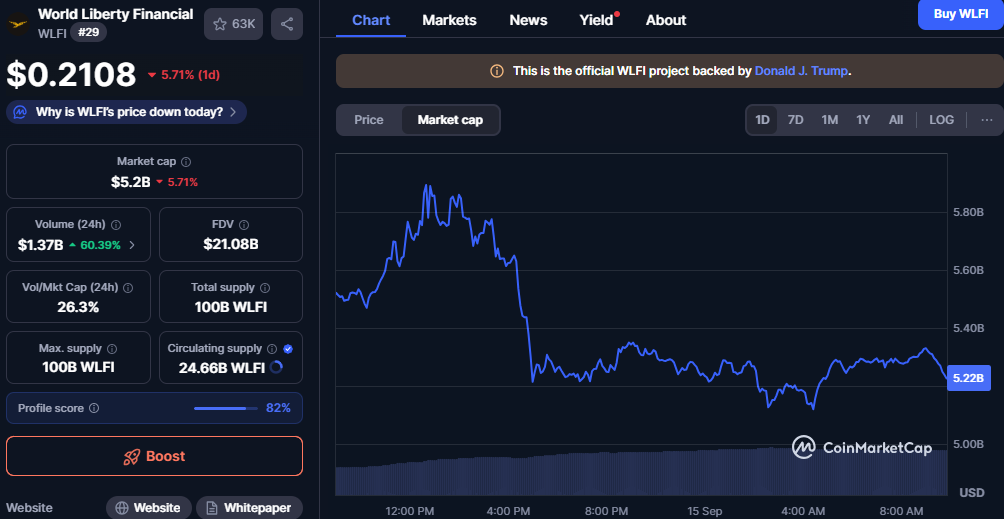

The World Liberty Financial [WLFI] has made sharp movements in the last one day, changes between profits and losses as the bulls and bears fought over the momentum. The token momentarily shot up to the double digits mark to stand at $0.2339 before dropping to a new figure of 0.2108. It is a volatile coin; nevertheless, its market value remained stable above 5.2 billion coins, which ranks WLFI as one of the 30 most popular cryptocurrencies.

Spot Selling and Derivatives Inflows.

Spot traders struck WLFI into exchanges both in the second and the third days, indicating profit-making and increased sells. The inflows pushed the supply in the market and strained the price action during the session. Consequently, there was a down trend in short-term momentum following the initial rise.

Source: Coinglass

The derivatives activity had shifted the other way around with long positions in the leading exchanges. The financing rates increased to 0.0373 indicating that the traders were paying premiums to hold a bullish position. This drift highlighted the fight over the short-term sellers and leveraged long players.

Despite increased selling pressure, derivatives inflows provided liquidity that prevented deeper losses. While spot volume suggested exits, the derivatives market signaled persistent optimism. This conflict shaped WLFI’s uneven trading path during the past 24 hours.

Price Action and Market Metrics

WLFI’s intraday high near $0.2317 quickly gave way to a drop into the $0.21 region. The token then consolidated within a narrow range, recording minor rebounds but lacking a strong recovery. Toward session close, price remained under pressure, reflecting continued weakness.

Source: CoinAlyze

Over one day, WLFI fell 5.71% and extended its weekly decline to 5.34%. Across 30-day, 90-day, and 180-day periods, losses stood at 8.85%, underlining consistent bearish momentum. These data points showed sustained challenges in regaining upward direction.

Despite price declines, trading volume surged 60.39% to $1.37 billion. The volume-to-market cap ratio of 26.3% confirmed strong liquidity turnover. Circulating supply reached 24.66 billion WLFI, or roughly a quarter of the total maximum supply.

Outlook and Governance Influence

Governance-backed proposals, including a burn mechanism, have kept long-side conviction strong in derivatives markets. These initiatives encouraged buying pressure even as spot traders exited. However, the balance between governance support and selling pressure remained uncertain.

Source: Coinmarketcap

Liquidation maps suggested higher probability for a rebound as clusters formed above current prices. Clearing these clusters could trigger renewed upward momentum. Yet, persistent selling pressure continued to signal potential downside risks.

Overall, WLFI displayed both strong liquidity and high volatility. Bulls sought support through derivatives and governance, while bears pressed through spot selling. The coming sessions will determine if the token stabilizes or extends its downward path.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.