- Accumulation Zone at $3 – XRP traders eye dips below $3 as prime entry levels before the next major breakout.

- Bullish but Overbought – Strong momentum keeps XRP above $3.10, but RSI above 80 signals risk of near-term pullback.

- Volatility Defines Trend – Market cap swings past $200B show explosive rallies, with $2.50–$3.00 now acting as critical support.

The XRP trades are strongly above 3, and the momentum indicators show a strong bullish trend, but indicators of overextension are indicative of a near-term consolidation. The market is seen to be supported by steady buyer power, which is encouraging of continuation. The existing structure is an indicator of the possible breakout in case the price clings to the important support levels.

XRP remains positioned in an accumulation phase after breaking out of earlier consolidation ranges. Traders continue to identify the $3 zone as pivotal. Price action suggests that further accumulation could be required before momentum drives a decisive breakout.

The use of Fibonacci levels highlights sub-$3 entries as strategic accumulation areas. The shaded zone signals where long-term participants may step in. Overhead resistance still restricts advances, indicating that patience may be required before larger gains emerge.

Recent strength has renewed optimism in the short term. Yet, XRP remains below major breakout points that would validate sustained momentum. Until then, the market structure favors accumulation strategies rather than chasing rallies.

Short-Term Momentum and Indicators

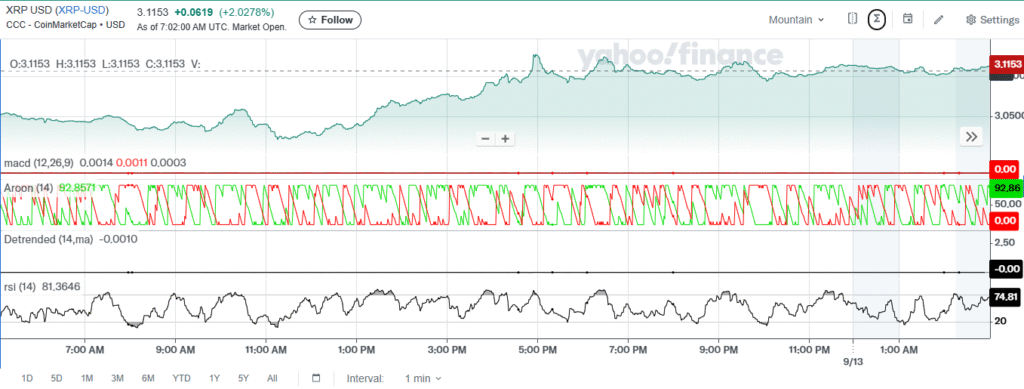

The current price of XRP/USD is at 3.1153, which is an increase of 2.02 percent in the previous session. The uptrend has short-lived pullbacks, which are resilient. A price stability of above 3.10 signifies good buying support following previous upward shoot ups.

Source: YahooFinance

The momentum indicators verify the existing strength. MACD is still a bit positive at 0.0014, but the histogram is not accelerated so much on the momentum. The Aroon indicator is an indicator of a strong bullish trend, where the Up value is approximately 92.85.

However, the RSI stands at 81.36, pushing into overbought conditions. This level increases the chance of a pause or correction. A consolidation period above $3.05 would keep the bullish structure intact despite short-term volatility.

Market Cap Recovery and Outlook

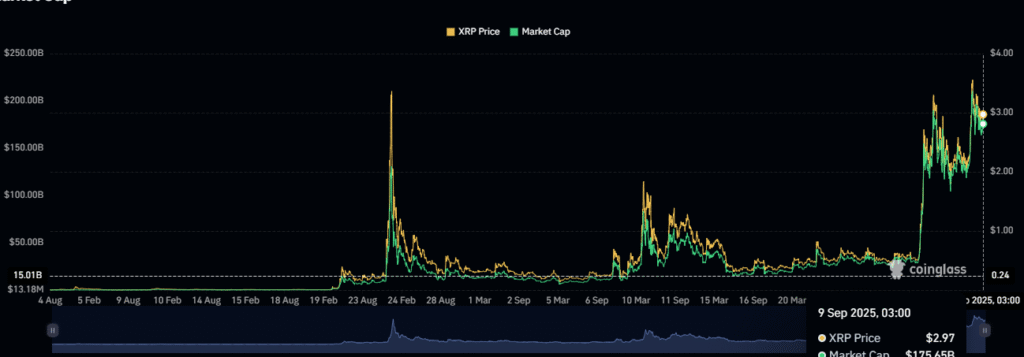

The broader trend shows XRP regaining market strength. Market capitalization has risen to nearly $176.45 billion, aligned with recent price gains. Previous rallies pushed capitalization briefly above $200 billion before retracements occurred.

Source: Coinglass

The yearly chart reveals strong volatility, with multiple spikes followed by sharp corrections. February’s rally above $3.50–$4.00 stands out as the largest move. Current consolidation around $3 suggests healthier positioning compared to earlier cycles.

If XRP sustains price action above $2.50 and stabilizes over $3, momentum may build toward another breakout attempt. Failure to maintain these levels could trigger a correction. However, continued support above $3 would validate further upside potential.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.