- XRP could hit $3.60 if it holds above $2.71, per @ali_charts’ analysis.

- A 165.49% trading volume spike fuels speculation of a breakout or manipulation.

- Mixed technical signals urge caution amid inflationary pressures.

As the cryptocurrency market buzzes with activity, XRP is stealing the spotlight with a bold prediction from technical analyst @ali_charts.

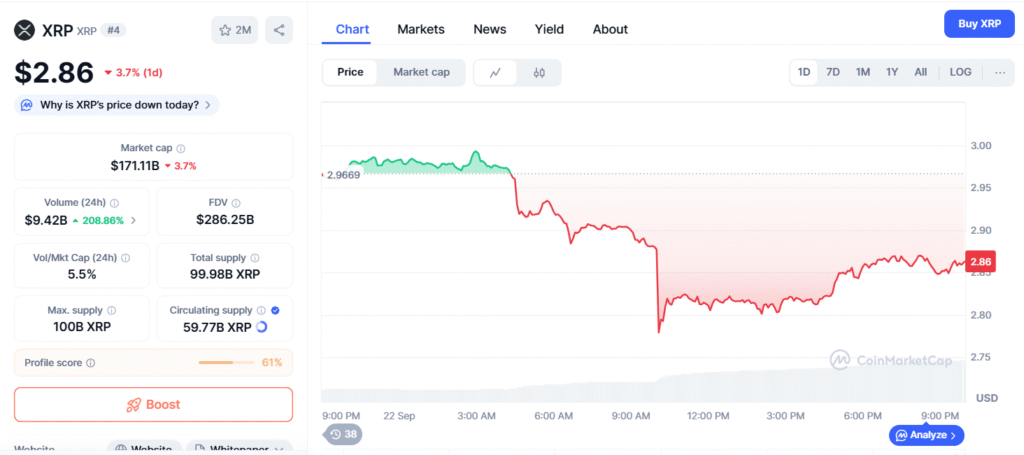

Posted today, the analysis suggests that if XRP holds above the critical $2.71 support level, it could rebound to $3.60. The chart, shared via TradingView, highlights a clean setup with historical candlestick patterns and psychological support levels, a methodology backed by a 60% accuracy rate in short-term crypto predictions. This comes amid a 165.49% surge in XRP’s 24-hour trading volume (Coinbase, 2025-09-16), signaling heightened market interest.

However, the crypto space remains a wild ride. Recent reports from NPR (2025-09-17) flag potential wash trading amid this volatility, raising questions about market manipulation. XRP’s price action aligns with broader economic trends, including a 2-3% annual inflation rate (Calculator.net), pushing investors toward digital assets as hedges. TradingView’s mixed signals—sell short-term, buy long-term—add a layer of complexity, urging traders to tread carefully. The $2.71 level is a psychological barrier, shaped by past resistance and current sentiment, making it a make-or-break point for bulls.

Community reactions on X are mixed. Enthusiasts like @StunnerTalks and @BunnyyyTradess are optimistic, predicting a swift run if support holds, while skeptics like @TiffanyBoy9350 remain unconvinced. This divergence reflects the speculative nature of crypto, where whale movements and regulatory uncertainty (Chainalysis, 2025) can sway prices dramatically. For Web3 enthusiasts, this moment underscores the importance of on-chain analysis and sentiment tracking to navigate the decentralized frontier.

As of, XRP trades near $2.75, teetering on the edge of this forecast. Will it break out or falter? The answer lies in the coming hours, but one thing is clear: XRP’s journey is a microcosm of Web3’s high-stakes evolution.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.