- XRP continues to defend its crucial $2.77 support level, signaling stability within its ongoing bullish macro cycle and preventing deeper corrections.

- The XRP community’s strong conviction and unified sentiment sustain market morale, framing short-term dips as opportunities within a broader accumulation phase.

- XRP’s multi-cycle chart pattern mirrors past pre-rally setups, suggesting a potential breakout above $3.50 that could initiate a new bullish expansion.

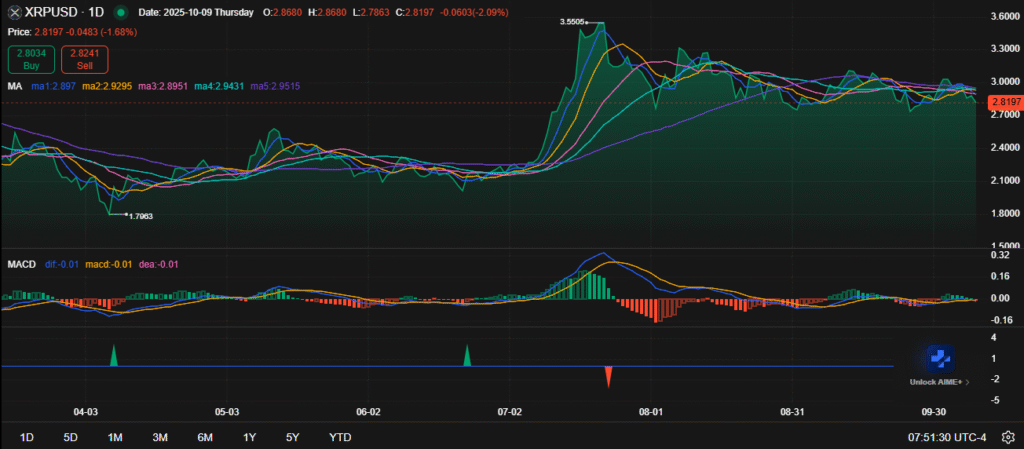

XRP continues to maintain its bullish stance as the asset consolidates above key support while traders anticipate renewed momentum. The price remains stable near the $2.80 range, reinforcing confidence in the ongoing market structure. Despite short-term volatility, the broader trend signals that XRP’s macro bull cycle is still active and preparing for potential expansion.

Community Sentiment and Market Behavior

XRP’s community maintains a strong and unified stance amid market fluctuations, emphasizing discipline and long-term conviction. Supporters continue to describe the recent price movement as temporary noise within a broader upward framework. This collective sentiment reflects resilience and an optimistic outlook that aligns with the coin’s historical recovery patterns.

Market participants view $2.77 as a key support level defining the current trading range. Holding above this threshold reinforces bullish continuation signals across higher timeframes. The consolidation phase suggests an accumulation zone rather than a reversal, setting the foundation for renewed breakout conditions.

The XRP community has consistently driven sentiment-driven rallies through confidence and coordinated market participation. This behavioral pattern often leads to strong recoveries once resistance levels weaken. Current positioning across social platforms indicates continued optimism ahead of potential macro-level price acceleration.

Technical Outlook and Structure

Technical indicators confirm that XRP remains structurally intact despite short-term corrections. The multi-cycle chart pattern highlights recurring accumulation phases followed by expansion waves, showing that XRP is entering another potential breakout cycle. Current market structure mirrors previous pre-rally setups, where compression preceded strong upward extensions.

Source: chart.ainvest.com

Analysts identify the $3.50 mark as a critical resistance area to monitor for a breakout confirmation. Sustained momentum above this level may trigger a continuation toward higher local targets. However, maintaining stability above $2.77 remains essential for sustaining market confidence and upward trajectory.

The overall technical alignment supports a positive continuation within the ongoing macro trend. While short-term corrections persist, structural signals favor long-term growth potential. XRP’s consistent defense of its lower range reinforces confidence in a developing bullish phase that could precede new all-time highs.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.