- CryptoQuant’s Bull Score Index drops from 70 to 50, shifting to “Neutral” amid Bitcoin’s 23% price decline.

- Reduced network activity and liquidity since December 2024 signal potential market cooling.

- Diversification and volatility tools are crucial for managing risks in this uncertain phase.

The cryptocurrency market is buzzing with a significant update from CryptoQuant. The Bull Score Index, a key on-chain metric tracking Bitcoin’s market sentiment, has dropped from 70 to 50, transitioning from a “Bullish Cooldown” to a “Neutral” phase.

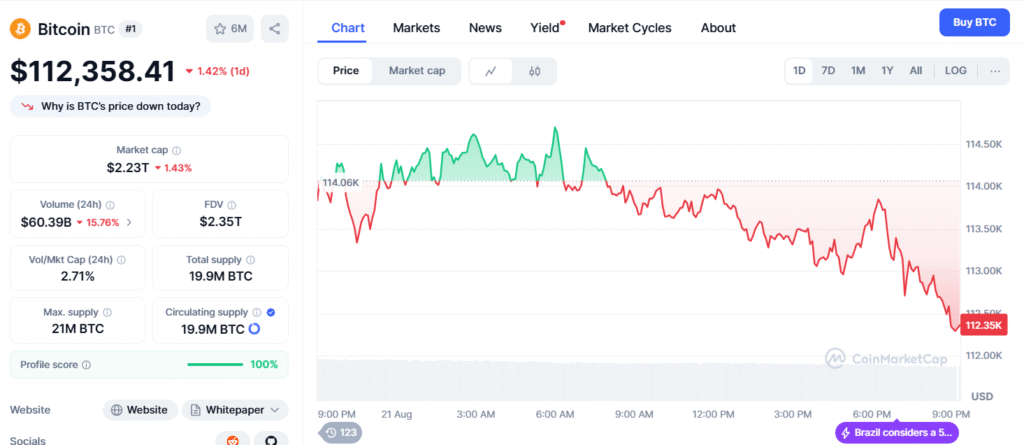

This shift, detailed in a post by Julio Moreno (@jjcmoreno) on X, suggests a potential price correction, with historical data indicating sustained rallies typically require a score above 60, while bear markets often emerge below 40 (CoinDesk, March 2025). With Bitcoin’s price recently dipping 23% from its January 2025 peak of $109,000 to around $84,000, this development warrants close attention.

The decline in the Bull Score Index aligns with broader market dynamics. CryptoQuant’s analysis points to reduced network activity and liquidity since December 2024, challenging the optimism surrounding Bitcoin’s post-halving rally. This cooling sentiment could signal a pullback, a pattern echoed by analysts who describe such dips as “standard” following rapid price surges (Bloomberg, 2025). For investors, this is a critical moment to reassess strategies, especially given the 24/7 nature of crypto markets, where volatility is amplified by factors like price discovery and liquidity flows.

Risk management is paramount in this environment. A June 2025 Payset study on cryptocurrency trading underscores the importance of diversification and hedging to mitigate losses during uncertain phases. Tools like Bollinger Bands and the Average True Range, as outlined in Blockworks’ volatility guide, can help investors navigate these choppy waters.

While the Neutral phase doesn’t guarantee a bear market, it serves as a cautionary flag. Staying informed with real-time data from platforms like CryptoQuant and adjusting portfolios accordingly could be the difference between capitalizing on opportunities and facing significant downturns.

As the market evolves, all eyes will be on whether Bitcoin can reclaim bullish momentum or if this marks the start of a deeper correction.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.