- BONK’s price hinges on holding above $0.x1500 for a bullish roadmap.

- Elliott Wave analysis identifies wave b support between $0.0001500-$0.0001857.

- High volatility signals both opportunity and risk for traders.

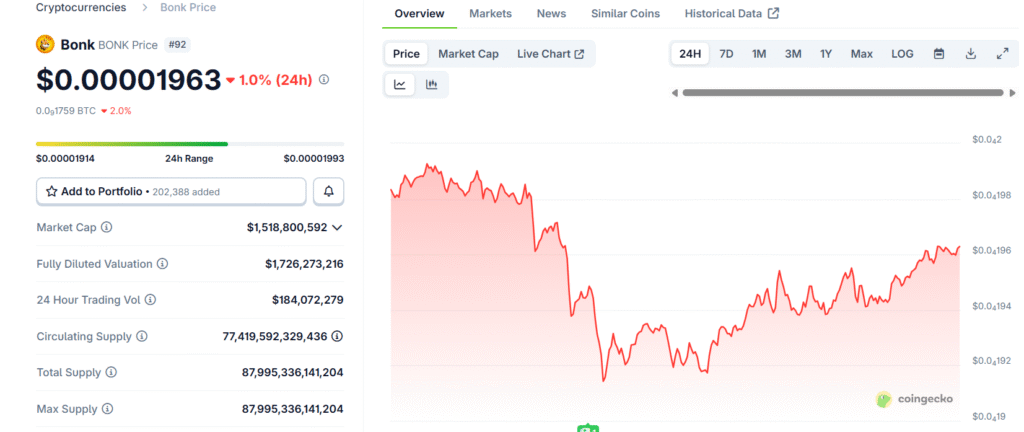

As the cryptocurrency market continues to evolve, Bonk (BONK), a popular Solana-based meme coin, is drawing significant attention from traders and analysts.

According to a recent analysis by More Crypto Online, posted on X on September 4, 2025, BONK is currently at a critical juncture. The chart, spanning from 2024 to 2026, highlights a potential reaction in the support zone for wave b, a key level in Elliott Wave Theory.

As long as the price holds above $0.x1500, the outlined roadmap remains intact, suggesting a possible bullish continuation if support holds. The analysis employs Elliott Wave principles, identifying waves i through iv, with wave b forming a corrective pattern. This indicates a temporary pullback before a potential upward move. The support zone, marked between $0.0001500 and $0.0001857, has historically acted as a floor, with a 61.00% Fibonacci retracement level reinforcing its significance.

However, the recent decline and high volatility in the crypto market, influenced by broader economic factors like US trade tariffs in Q1 2025, add uncertainty. Traders are cautioned to monitor this level closely, as a break below could invalidate the bullish scenario, potentially driving prices toward $0.x0500 as suggested by community insights. Community reactions on X reflect a mix of optimism and caution.

Some users request further technical analysis, such as a YouTube breakdown, while others speculate on a five-wave downtrend before a pump, a pattern Bonk has exhibited in past cycles. With BONK’s market cap at $14 billion and a ranking of #88 on CoinGecko, its volatility remains a double-edged sword, offering both risk and reward. As, all eyes are on this support zone. Will BONK rebound, or is a deeper correction on the horizon? Stay tuned for updates.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.