- Cardano gathers around the price of about $0.87 with good liquidity in the form of a wedge, and it represents a possible breakout.

- The supply is steady since 81 percent of ADA are already in circulation, which minimizes the risk of dilution and promotes the scarcity in the long term.

- Breaking the resistance level of more than 0.90 would open the door to some ambitious goals of 3, 5 and 8 which are in line with the past liquidity bands.

Cardano is stable at the range of 0.87 since trading activity indicates accumulation, and structure points to possible growth. ADA is in the market at the demand zone of 0.85, and the momentum can be tested on the higher targets. As liquidity levels remain high and supply forces remain steady, Cardano remains in a neutral to bullish position as traders are waiting to be proven correct above $0.90.

Cardano Price Action

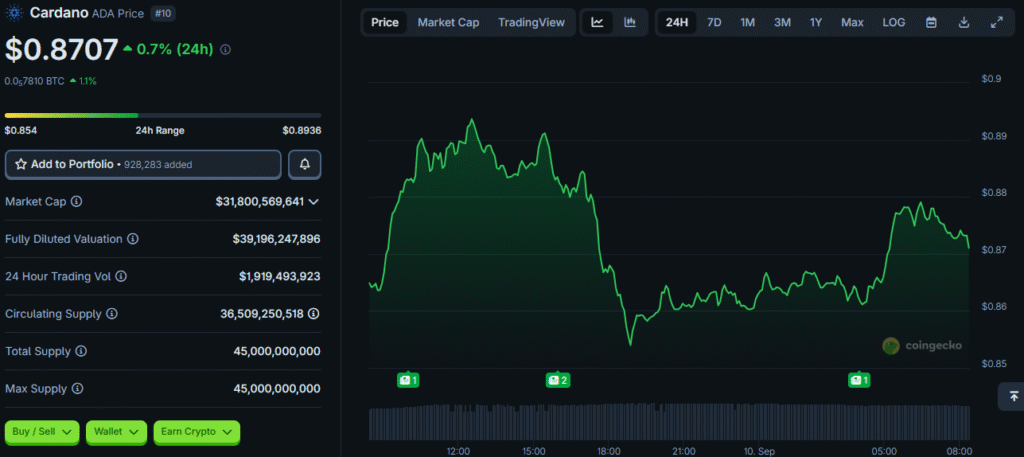

Cardano stands at 0.8707 trade with a 0.7 percent improvement in the last day. The 24-hour range was 0.854 to 0.8936. The intraday chart showed an initial rally, a pullback, and a partial recovery that still left ADA in consensus.

Its market capitalization was 31.8 billion and fully diluted valuation is 39.2 billion. Circulating supply amounts to 36.5 billion or approximately 81 percent of the maximum supply. Therefore, dilution pressure remains minimal since most tokens are already in circulation.

Trading volume hit $1.91 billion over the past 24 hours, representing nearly 6 percent of total market capitalization. This healthy ratio reflects liquidity depth and continued participation, enabling smoother execution of trades without major slippage. Sustained activity often precedes stronger directional price moves.

Structural Setup and Supply Dynamics

ADA holds within a long-term wedge pattern that compresses volatility and signals potential breakout. The key support band remains $0.85 to $0.60, while resistance stretches toward $0.90 and $1.00. Breaking above resistance would open the path toward higher liquidity targets.

Source: Coingecko

Tokenomics underpin Cardano’s supply stability with a fixed cap of 45 billion ADA. With the majority already unlocked, price action depends primarily on demand growth and adoption. Therefore, expansion across applications and networks remains vital to sustain upward momentum.

The capped structure aligns ADA with deflationary-style assets such as Bitcoin. Scarcity strengthens price resilience during accumulation phases, especially when paired with stable liquidity conditions. However, failure to hold current support would risk renewed pressure and deeper consolidation.

Long-Term Outlook

Technical projections highlight ambitious targets of $3, $5, and $8 if ADA clears structural resistance. These levels align with historical liquidity zones where significant trade volumes previously concentrated. Reclaiming those price regions would confirm expansion beyond the current consolidation.

Broader market context links ADA’s trajectory to altseason cycles. When Bitcoin stabilizes, capital rotation historically fuels growth across major altcoins. Consequently, Cardano could benefit significantly if risk appetite expands throughout the market.

Short-term, $0.85 remains the pivotal level. Holding this floor supports attempts toward $1 and beyond, while losing it exposes $0.60. Therefore, the path forward depends on sustained strength at support and a decisive break above resistance.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.