- Ethereum sees support around $3,515 as whale inflows increase from T Rex ETF launch.

- Ethereum’s price struggles below $4,000 amid technical risks of a deeper drop.

- T Rex’s BitMine ETF brings $32 million on day one, signaling corporate ETH interest.

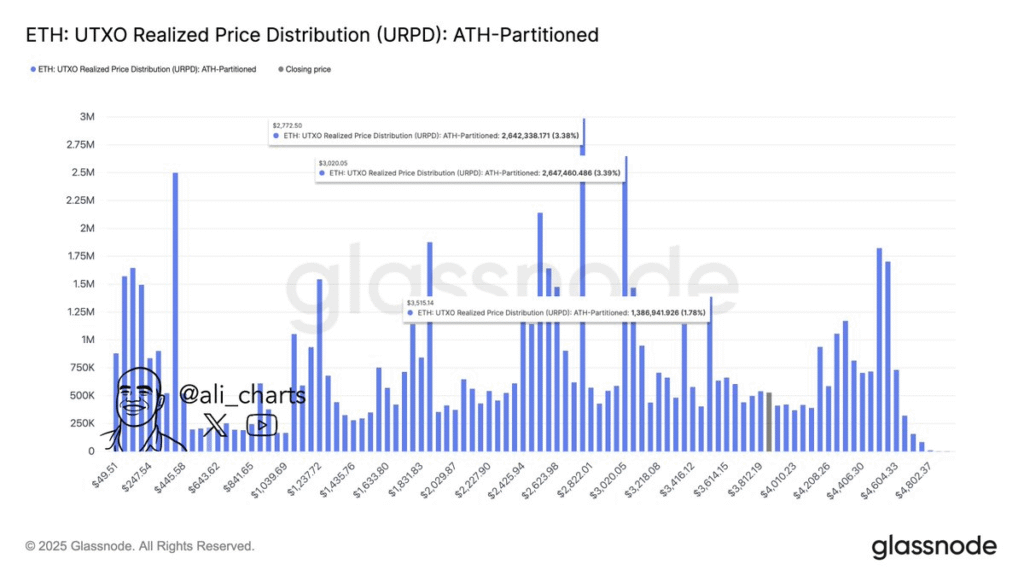

Ethereum has encountered notable price fluctuations in recent weeks. According to Ali Martinez’s analysis, key support levels for Ethereum ($ETH) are positioned at $3,515, $3,020, and $2,772.

These levels, highlighted in Glassnode’s ETH UTXO Realized Price Distribution (URPD) chart, reflect areas where substantial ETH transactions have historically taken place.

The $3,515 level is the most critical point, with strong transaction volumes supporting this price range. Should Ethereum retrace further, traders may closely monitor these levels for potential price stabilization.

T Rex ETF Draws Institutional Support with $32 Million Inflows

Meanwhile, Ethereum has seen a notable surge in institutional interest. On its first trading day, T Rex’s BitMine ETF (BMNU) secured $32 million in inflows.

This launch offers corporate investors leveraged exposure to Ethereum through BitMine’s (BMNR) stock price. Eric Balchunas, Chief ETF Analyst at Bloomberg, noted that the BMNU’s strong start ranks among the third-largest first-day inflows for ETFs listed in the U.S. in 2025.

This surge highlights growing demand for Ethereum despite recent price retracements, signaling continued institutional interest.

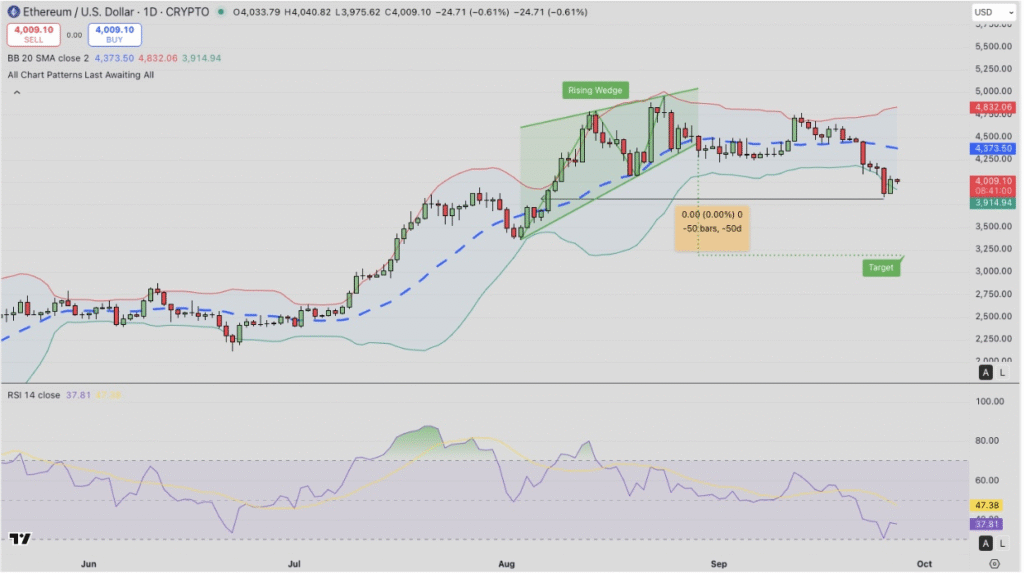

Ethereum Price Forecast and Technical Outlook

Ethereum’s price outlook remains somewhat uncertain despite these institutional gains. The cryptocurrency has struggled to maintain its $4,000 level, influenced by rising wedge patterns and technical volatility. Ethereum’s recent movement suggests that if it fails to hold the $4,000 level, a decline toward $3,200 could follow.

Additionally, expanding Bollinger Bands suggests increased volatility, with the price trading near the lower band at $3,916. If Ethereum fails to break the $4,000 resistance, a drop below this mark could signal further downside risk.

In terms of support, a consolidation above $4,000 could allow Ethereum to test higher levels near $4,373. However, traders must remain cautious as the rising wedge pattern indicates a potential deeper retracement, with critical support expected at $3,515, $3,020, and $2,772.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.