- Altcoin market drops 60–80% since October; TAO down 75%.

- Traders show interest in TAO with accumulation during the decline.

- Chart patterns suggest possible early-stage support building.

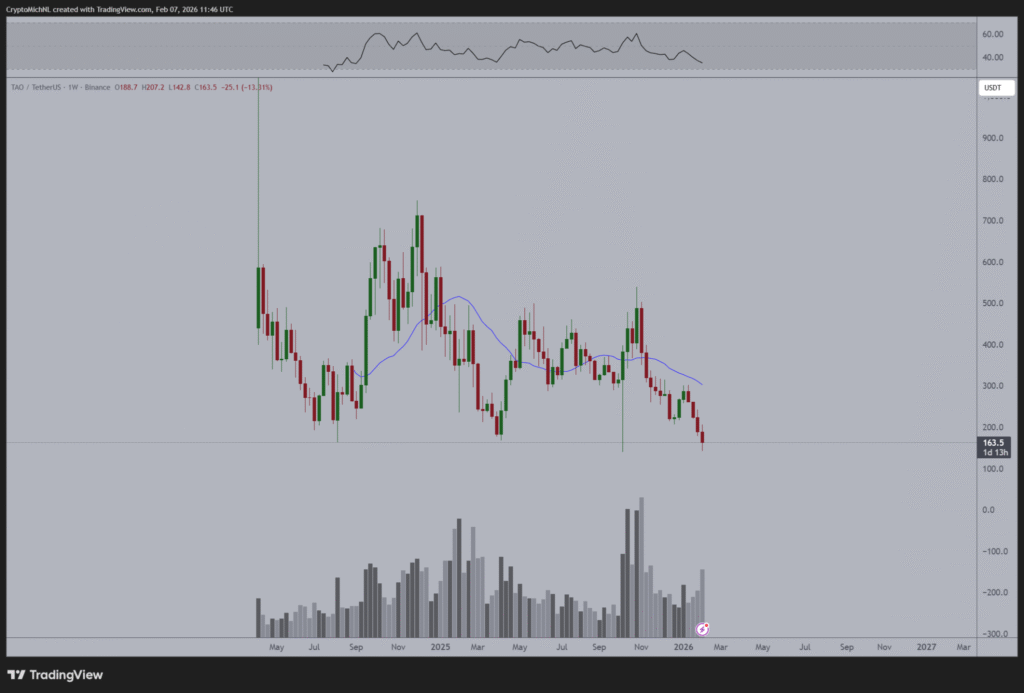

TAO has dropped nearly 75% since October, reflecting the broader altcoin market decline. Many digital assets are now down between 60% and 80%. Despite this pressure, some traders are increasing exposure, citing rising volume and long lower wicks as early signs of accumulation near the current price levels.

Altcoin Market Drop Continues Amid Signs of Price Stabilization

The altcoin market has recorded deep losses since October, with several digital assets falling by more than 70%. TAO, a lesser-known token, has dropped by approximately 75 percent during this period.

Analyst Michaël van de Poppe noted this in a recent post, indicating growing interest among traders despite the downtrend. As many crypto market participants face volatility, some are starting to position themselves for a possible recovery.

Weekly trading charts show sharp declines with extended lower wicks, suggesting potential buying pressure at current levels. Van de Poppe said, “I’ve been accumulating this one over the past weeks.” This type of accumulation is often seen when traders believe the market may be close to a cycle low.

Traders Add TAO to Portfolios While Altcoin Market Declines

TAO’s price has declined from above $600 to near $160 in recent weeks. The TradingView chart confirms this sharp drawdown, along with a visible rise in volume near the lows. This combination typically indicates capitulation, when sellers exit and buyers cautiously return.

The broader altcoin market continues to struggle under downward pressure, yet many assets display long lower wicks. These wicks, combined with increased volume, can mean accumulation is underway. Traders are watching this setup closely as it may signal the start of base-building for a future rally.

Exchange activity and trading volume spikes are often early signs of sentiment shifts. While the crypto market remains volatile, traders seem to be recalibrating portfolios around assets they view as undervalued. Van de Poppe added TAO to his altcoin portfolio and highlighted its potential position near the bottom.

Even though price trends remain weak, some digital asset investors are treating this correction as a strategic entry point. Market data support cautious optimism, especially where volume rises near historical support.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.