- Solana is bouncing at $75 after a sharp decline from its peak.

- Analyst Crypto Tony maintains a minimum macro target of $50 for SOL.

- The move is not considered a bottom, despite short-term support reaction.

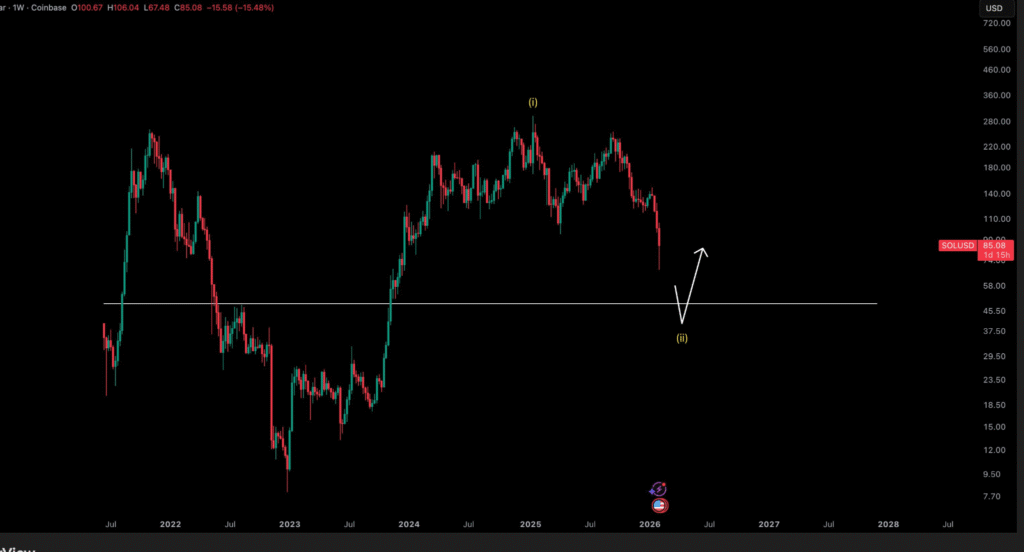

Solana is showing a short-term bounce at a key horizontal level near $75. However, analyst Crypto Tony has shared a broader outlook, suggesting the move is not yet a bottom. His long-term view points to a minimum downside target closer to $50.

Solana Reacts at $75 Support But Macro Trend Points Lower

Solana is currently testing a horizontal support zone near $75, after several weeks of downward pressure. This level has attracted interest from traders watching for potential short-term relief. According to technical analyst Crypto Tony, the bounce is expected but not considered a full trend reversal.

The macro chart shared shows a clear wave structure, where the current movement is labeled as part of a larger correction. The key level at $75 had previously been shared by the analyst as a point of interest. However, he noted that a more likely support area remains lower.

Analyst Maintains $50 Minimum Target Despite Temporary Relief

In a recent post, Crypto Tony wrote, “We are bouncing now at a key level at $75… but by no means is this a bottom for me. $50 minimum target overall.” This indicates his longer-term outlook remains bearish unless Solana forms a confirmed reversal.

The chart projects one more wave to the downside before a potential recovery. $50 is marked as the final corrective target based on wave structure. If the price breaks below current support, it may validate the view that further losses are still likely before SOL finds its macro low.

Solana has been under pressure since mid-2025, with no confirmed higher low structure forming yet. Traders are watching for a possible trend shift but remain cautious while the macro target of $50 remains active.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.