- SOL attempts to break trendline while short-term momentum remains weak.

- Fibonacci levels suggest support near 78.07, 75.53, and 72.04.

- Resistance observed around 89.61 as CPI data could influence prices.

Solana (SOL) is showing signs of trying to break a descending trendline on short-term charts. Analysts warn momentum remains limited, and price action may stay muted ahead of U.S. CPI data.

Solana Tests Key Trendline on Short-Term Charts

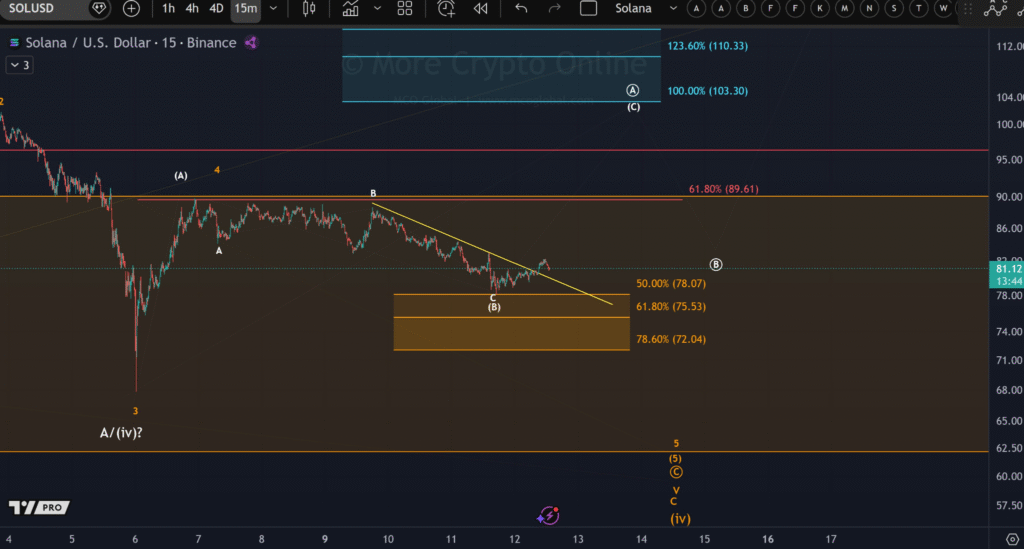

Solana (SOL) is attempting to break above a descending yellow trendline on the 15-minute Binance chart. Analysts report that only three waves to the upside are visible so far, indicating the move may be corrective rather than impulsive.

According to More Crypto Online, traders are watching Fibonacci retracement levels as potential support zones. The levels identified are 78.07 (50%), 75.53 (61.8%), and 72.04 (78.6%). These points could act as temporary pauses if the price faces downward pressure.

The short-term trend remains cautious as upward momentum is weak. Analysts note that a further decline in wave (B) is still possible, meaning SOL could test lower support before resuming any significant upward move.

Resistance and Market Conditions Ahead of CPI Release

Resistance for SOL is noted near 89.61 (61.8% Fibonacci level). The analyst suggests this area may prevent SOL from gaining strong upward traction unless market conditions change.

Market participants are also closely monitoring upcoming U.S. Consumer Price Index (CPI) data. The report may affect investor sentiment and limit major price movements for SOL and other cryptocurrencies. A cautious approach is advised, as volatility may increase once the CPI numbers are released.

More Crypto Online stated, “The market could remain range-bound until CPI data provides clear direction.” Traders may need to wait for confirmation of momentum before entering new positions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.