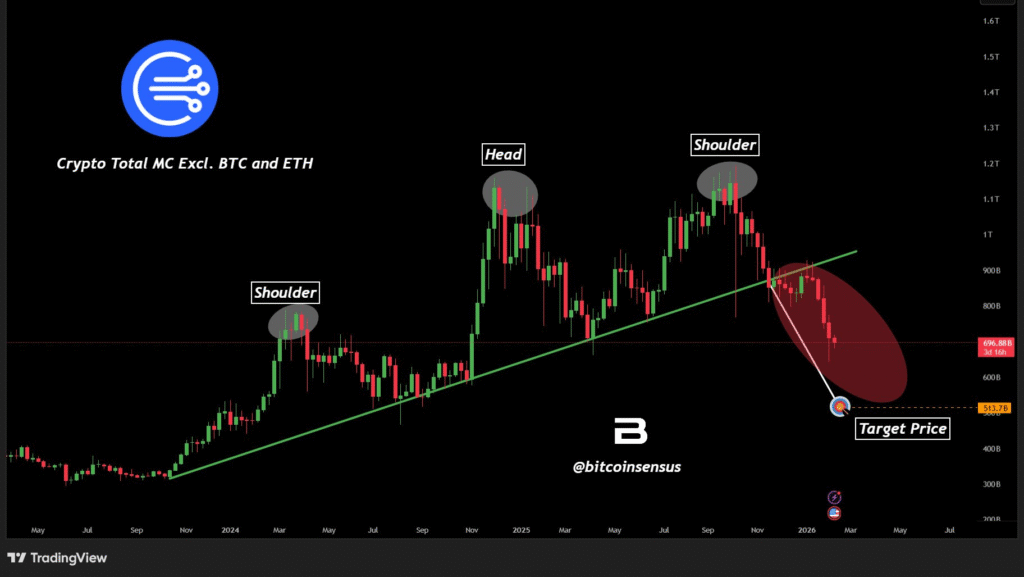

- Altcoin market cap excluding Bitcoin and Ethereum forms a Head and Shoulders.

- Breakdown below rising trendline points to measured move near $513 billion.

- Technical pattern suggests altcoins could face another downward leg.

Altcoins are showing signs of weakness after forming a clear Head and Shoulders pattern. The total market capitalization excluding Bitcoin and Ethereum has broken below a rising trendline. Analysts suggest this technical setup could point toward further downside for altcoins.

Altcoin Market Cap Confirms Head and Shoulders Formation

According to analysis by Bitcoinsensus, the total crypto market capitalization excluding Bitcoin and Ethereum shows a major topping pattern. The Head and Shoulders formation is clearly marked with both shoulders and the head visible.

The market has already broken below a rising green trendline, which signals weakening structure after several months of upward movement. Analysts note that this pattern typically indicates potential downside for altcoins, though the commentary is not financial advice (NFA).

Bitcoinsensus tweeted, “ALTCOINS HEAD & SHOULDERS BREAKDOWN. Total MC (excl. BTC & ETH) confirms a major topping pattern.” This highlights the importance of technical signals in tracking the broader altcoin market.

Trendline Breakdown Points Toward $513 Billion Target

The measured move from the Head and Shoulders pattern projects a target near $513 billion for the altcoin market cap. If the breakdown continues, altcoins could experience another leg down in market valuation.

Analysts caution that the pattern does not guarantee outcomes, but technical traders use it to gauge potential risks. The breakdown below the green trendline confirms that short-term momentum is weakening.

The pattern appears after months of gains in altcoins, suggesting the market may be pausing for a correction. Traders may use this technical setup to evaluate risk management strategies in portfolios.

Bitcoinsensus emphasized that the move is not financial advice and serves as analysis for market participants monitoring altcoin trends.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.