- El Salvador’s first gold purchase since 1990 added 14,000 oz worth $207M.

- Bitcoin accumulation paused in February 2025, the IMF confirmed in its July report.

- Internal BTC transfers continue, but are not new government buys.

El Salvador has officially paused its daily Bitcoin acquisition plan, which began in late 2021 under President Nayib Bukele. The International Monetary Fund (IMF) confirmed in its July 2025 review that no new state-backed Bitcoin purchases have taken place since February this year.

While blockchain data shows regular 1 BTC transfers to government-controlled wallets, these are internal movements and not new acquisitions. These transfers were frequently interpreted as part of Bukele’s “1 Bitcoin a day” plan. However, according to the IMF, no fresh purchases have occurred during this period.

In response to IMF guidelines on reserve diversification, El Salvador has opted to add gold to its international holdings for the first time in over three decades.

$207 Million in Gold Added to National Reserves

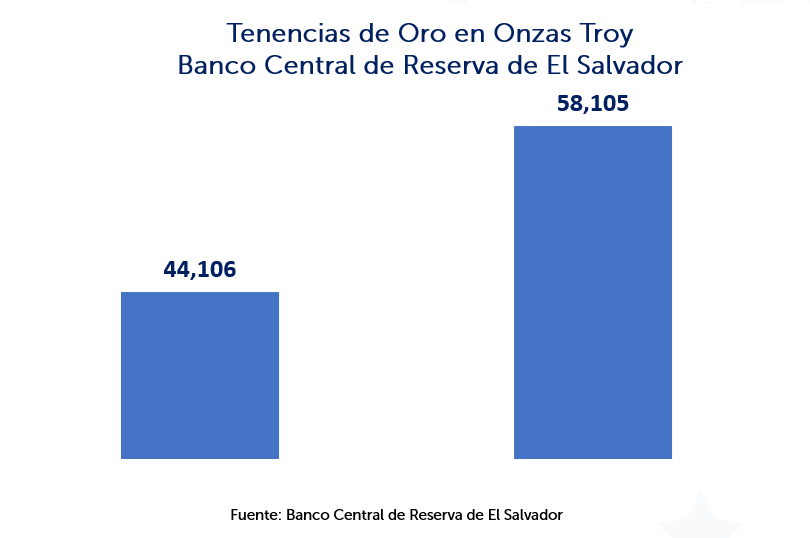

According to the Central Reserve Bank of El Salvador (BCR), the country acquired 13,999 troy ounces of gold worth approximately $207.4 million. This raised its total gold reserves from 44,106 to 58,105 troy ounces. This purchase marks the country’s first precious metals acquisition since 1990.

The BCR reported that the transaction was made in accordance with the IMF’s recommendations. The fund has advised member nations to maintain balanced reserve portfolios, especially during periods of market volatility.

“The acquisition aligns with our strategic reserve policy and reflects ongoing diversification,” the BCR stated in its official release.

Future of Bitcoin Strategy Remains Unclear

The country’s Bitcoin wallets continue to show daily movements of 1 BTC, often from Binance hot wallets to the government’s cold storage addresses. However, these are now categorized as internal transfers, not new market buys.

President Bukele has not released any new statements about the status or future of the Bitcoin accumulation plan. Despite the halt, existing holdings remain in government cold wallets.

As of now, there is no confirmation of whether the Bitcoin purchase strategy will resume. The focus, at least for now, appears to be on gold as part of reserve diversification.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.