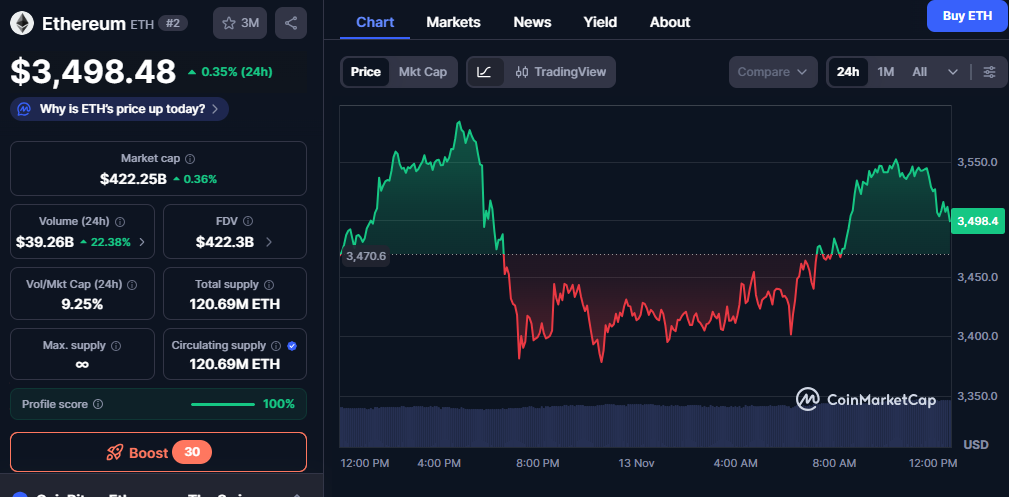

- Ethereum’s price has increased by 0.35%, indicating a stable upward movement and potential for further gains.

- The 22.38% increase in 24-hour trading volume shows heightened market participation, fueling bullish sentiment.

- Ethereum is facing critical resistance at $3,500, and a breakout above this level could trigger significant price movement.

Ethereum (ETH) is showing signs of strength, with recent price movements reflecting a positive shift in market sentiment. The price of Ethereum has increased by 0.35% over the past 24 hours, now sitting at $3,498.48. This stable upward movement suggests that Ethereum could be primed for further gains, especially with increasing trading volume and market participation.

Price Action and Market Capitalization

Ethereum has maintained a solid market capitalization of $422.25 billion, solidifying its position as the second-largest cryptocurrency by market cap. This demonstrates significant investor confidence, as Ethereum continues to perform strongly in the market. The price action shows a healthy mix of stability and gradual upward movement, which is indicative of strong investor sentiment and continued support for the asset.

Despite minor fluctuations, Ethereum’s recent price is hovering around $3,500, signaling that it is testing key resistance levels. The 24-hour trading volume stands at $39.26 billion, which represents a 22.38% increase in volume. This rise in volume indicates increased market interest, suggesting that more traders are becoming active, contributing to the growing bullish momentum.

Volume and Liquidity Indicators

The volume/market cap ratio for Ethereum is at 9.25%, showing that Ethereum is experiencing active trading with healthy liquidity. This ratio indicates that the market is absorbing price movements efficiently, which is typical of an asset in a steady uptrend. The volume increase combined with positive price action strengthens the case for Ethereum’s upward momentum, suggesting the asset is in a favorable position for growth.

Source: CoinMarketcap

Ethereum’s circulating supply is listed at 120.69 million ETH, and the total supply matches the circulating amount. This fixed supply is crucial for long-term valuation, as it plays a key role in demand and price determination. The stability of the circulating supply, paired with an increase in demand, supports the bullish outlook for Ethereum in the near term.

Resistance and Future Outlook

As Ethereum continues to test resistance levels, the price movement suggests that Ethereum is at a critical point in its price cycle. Ethereum faces resistance near the $3,500 mark, and a breakthrough above this level could signal the start of a more significant price rally. The current price action indicates a strong battle between buyers and sellers, with Ethereum’s ability to break resistance being the key to a potential price surge.

Ethereum’s recent performance, marked by increasing volume and a solid market capitalization, shows strong bullish sentiment. The current price action and trading volume suggest that Ethereum could continue to see upward momentum if it successfully breaks through key resistance levels. Traders and market participants will be keeping an eye on Ethereum’s ability to hold above current levels, as a breakout could indicate further gains in the coming days.

Disclaimer: The information in this press release is for informational purposes only and should not be considered financial, investment, or legal advice. Coin Crypto Newz does not guarantee the accuracy or reliability of the content. Readers should conduct their own research before making any decisions.