- Ethereum trades at $3,849 after falling to $3,681.91 amid $884.82M in liquidations.

- ETH chart resembles Gold’s prior breakout pattern above $2,000 resistance.

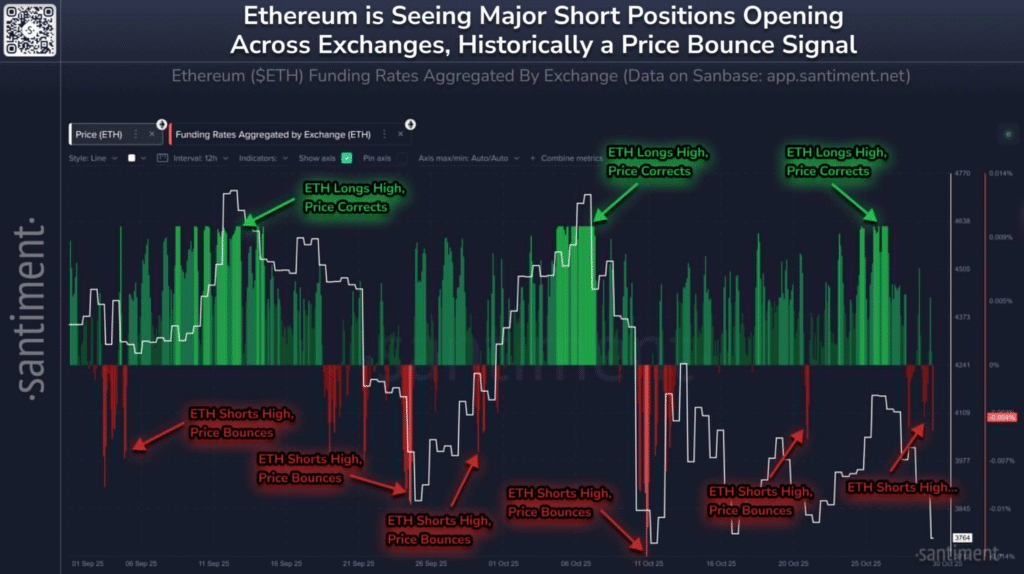

- Deep negative funding rates suggest trader panic and potential short squeeze setup.

Ethereum has shown a chart structure that resembles Gold’s previous breakout pattern, according to data shared by Mikybull Crypto. In the shared analysis, Gold had consolidated near $2,000 before rallying to over $3,000.

Ethereum is now trading near a similar historical resistance at around $4,000, with the price forming a flag-like consolidation. The chart highlights a breakout from a falling wedge followed by a retest of the $2,000 zone in Gold before a sharp uptrend.

Ethereum’s price movement appears to be tracking a nearly identical setup, with the $4,000 region acting as the breakout level. Traders are closely watching this pattern for a potential continuation to the upside.

Liquidations Mount as Ethereum Recovers from Daily Low

On October 31, Ethereum fell sharply to $3,681.91 before rebounding to $3,849.76. The drop occurred amid growing concerns in the cryptocurrency market. The Fear & Greed Index slipped to 31, indicating rising fear. Over $884.82 million in positions were liquidated in the last 24 hours, according to Coinglass.

Of this, $764.39 million was in long positions, indicating how many bullish traders were caught off guard. Only $120.42 million were shorts. This long liquidation trend shows excessive leverage in the market. Analysts warn that this could lead to further downside pressure if bullish traders do not reduce their exposure.

Funding Rates Turn Negative as Fusaka Upgrade Nears

Ethereum’s funding rates have turned deeply negative, according to Santiment. “Historically, ETH tends to bounce when shorts rise fast,” Santiment said in a recent update. Short interest has surged as ETH dropped below $3,700, a trend often seen as a precursor to recovery in previous cycles.

Data from CryptoQuant also shows long liquidations remain dominant. Analysts noted that the market remains tilted toward long positions, which can trigger further pullbacks.

Still, the upcoming Fusaka upgrade may offer long-term support. Scheduled for December 3, the update will increase blob data capacity and enhance Ethereum’s Layer-2 performance.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.