- $FLOKI price up 6.37%, reaching $0.08385 with sharp increase in social engagement.

- Floki community engagement hits 241,869, with over 41K interactions in one day.

- Data from LunarCrush shows $FLOKI could be signaling a bottom amid rising social interest.

Floki ($FLOKI) is showing early signs of recovery. According to LunarCrush’s recent data, its price increased by 6.37% to $0.08385 over a 24-hour period. This surge coincides with a sharp rise in social activity, as the number of social engagements related to Floki jumped significantly.

The total engagement reached 241,869, reflecting a growing interest in the coin. The community’s interactions saw a notable spike, with over 41,000 engagements on the 26th alone, pointing to increasing investor attention.

Despite a slight dip in engagement on the 25th, the overall trend has been positive. This could signal a shift in market sentiment, as community activity often precedes price movements.

Chart Analysis Shows Potential for Future Growth

However, a chart shared by Professor Astroneson on Twitter adds to the optimistic outlook for $FLOKI. The chart illustrates a classic ascending channel pattern, a bullish sign that suggests the coin may be poised for further price increases.

The chart uses data from TradingView, showing $FLOKI moving within upward-sloping trendlines. These boundaries represent key support and resistance levels.

The coin is currently in a corrective phase, but experts suggest that if the price continues to follow this pattern, it could soon break out and enter a bullish phase. If the trend continues, $FLOKI may reach higher price targets by the end of the year.

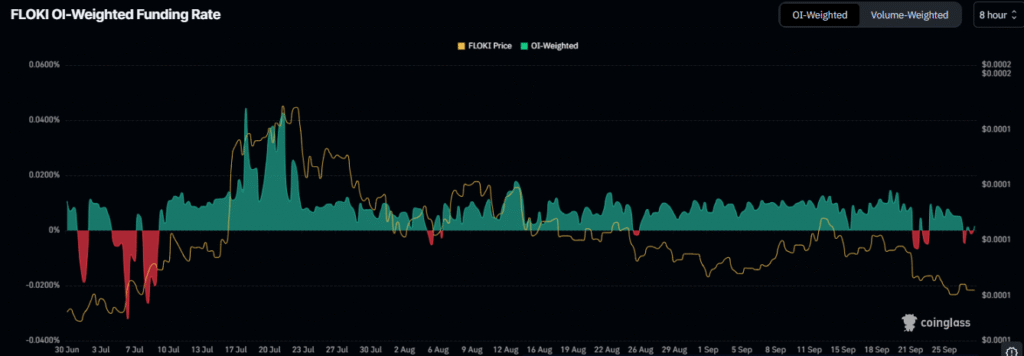

Funding Rate Data Supports Bullish Sentiment

Meanwhile, insights from Coinglass’s OI-weighted funding rate data show fluctuations in market sentiment. The funding rate, which tracks investor interest in leveraged positions, correlates closely with $FLOKI’s price movements.

However, Positive funding rates often precede price increases, while negative funding rates align with price declines. From June to September 2025, these fluctuations indicate a direct relationship between the funding rate and price changes.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.