- Galaxy Digital sold 1,610 BTC, contributing to Bitcoin’s decline below $110,000.

- The sell-off is marked by sharp outflows, signaling potential market pressure.

- Bitcoin trades around $109,576, testing key support levels after a 13% drop.

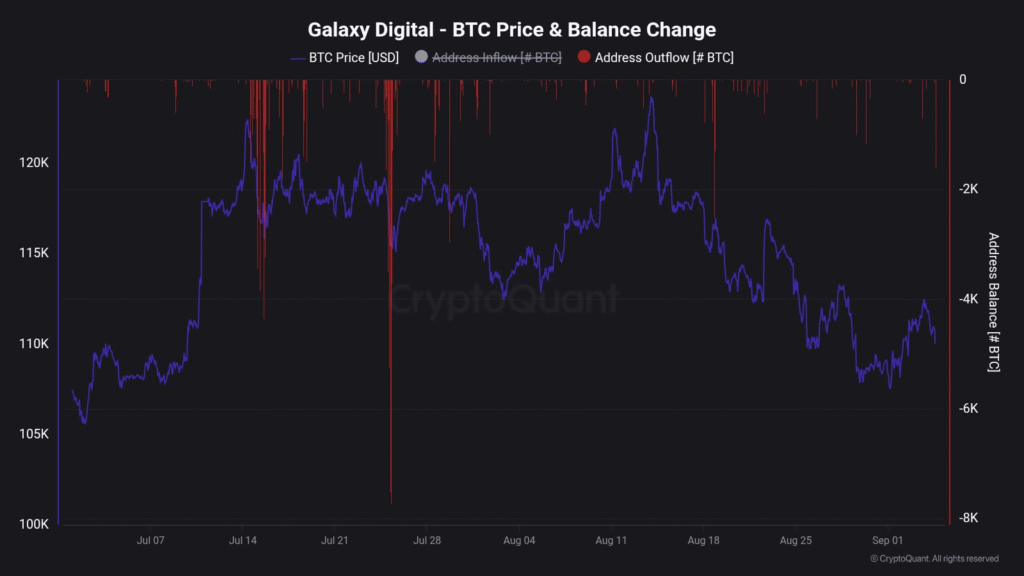

Galaxy Digital, a prominent crypto investment firm, has recently conducted a significant Bitcoin sell-off, unloading 1,610 BTC. CryptoQuant data shows that the firm’s Bitcoin balance has seen notable fluctuations in recent months, aligning with market shifts.

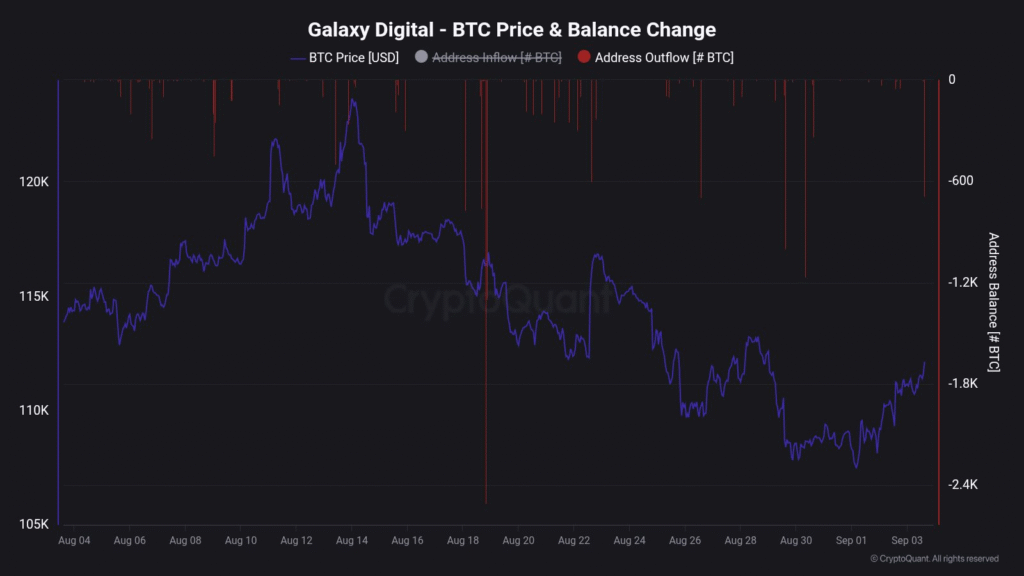

The firm’s wallet activity highlights substantial outflows, particularly in early September, amid a decline in Bitcoin’s price. Currently, Bitcoin trades near the $110,000 mark, with traders and analysts closely observing the effects of Galaxy Digital’s actions on the broader market.

Galaxy Digital’s Bitcoin Sell-Off

CryptoQuant data reveals that Galaxy Digital’s Bitcoin wallet has experienced sharp outflows, particularly marked by an hourly drop of -691 BTC. These outflows suggest increased selling pressure, aligning with Bitcoin’s recent decline from its mid-August highs.

Over the last two months, Bitcoin has fluctuated between $105,000 and $120,000, reflecting market volatility. Galaxy Digital’s latest move, unloading over 1,600 BTC, signals potential market implications, as large-scale transactions can impact Bitcoin’s price and liquidity.

The chart provided by CryptoQuant shows a clear downward trend, with red markers indicating the firm’s wallet outflows. These outflows, particularly in early September, have been sharp, highlighting Galaxy Digital’s strategic repositioning.

The increase in withdrawals coincides with Bitcoin’s decline, suggesting that the firm might be reacting to the prevailing market uncertainty. Analysts suggest that such large transactions can widen the market spread, creating a domino effect on liquidity and market volatility.

Bitcoin Price Analysis and Market Impact

As Bitcoin’s price hovers near $109,576, it faces significant resistance. After a failed retest near $122,000, the cryptocurrency dropped by nearly 13%, leading to a break below key support levels, such as the bullish order block and $112,000 support.

With sellers still dominating the market, the outlook remains bearish unless Bitcoin can reclaim crucial support levels. If the price fails to recover above $112,000, the next support lies at $101,407.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.