- HBAR shows a bullish divergence on RSI, hinting at a possible trend reversal.

- HBAR’s price remains near $0.16, testing key support amid recent sell-offs.

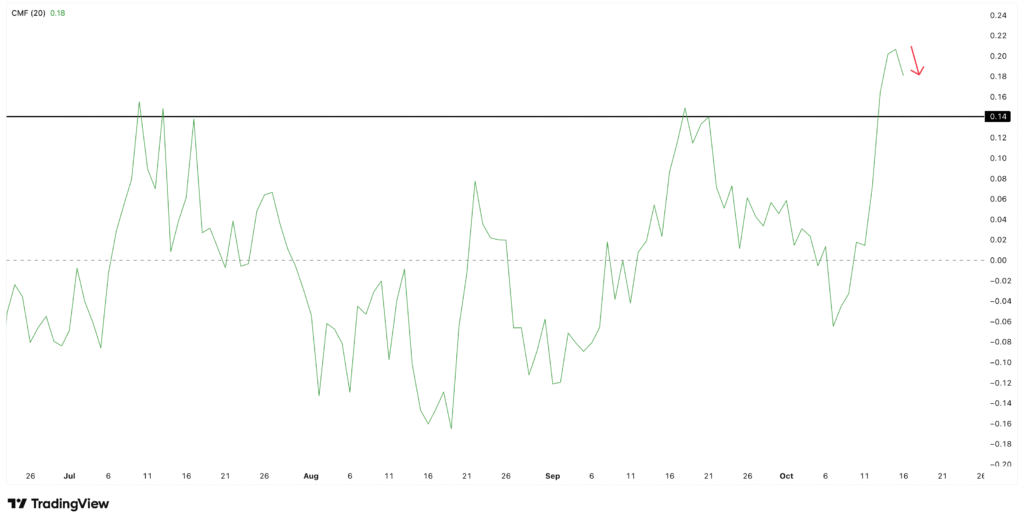

- The CMF stays positive at 0.18, signaling continued investor interest despite corrections.

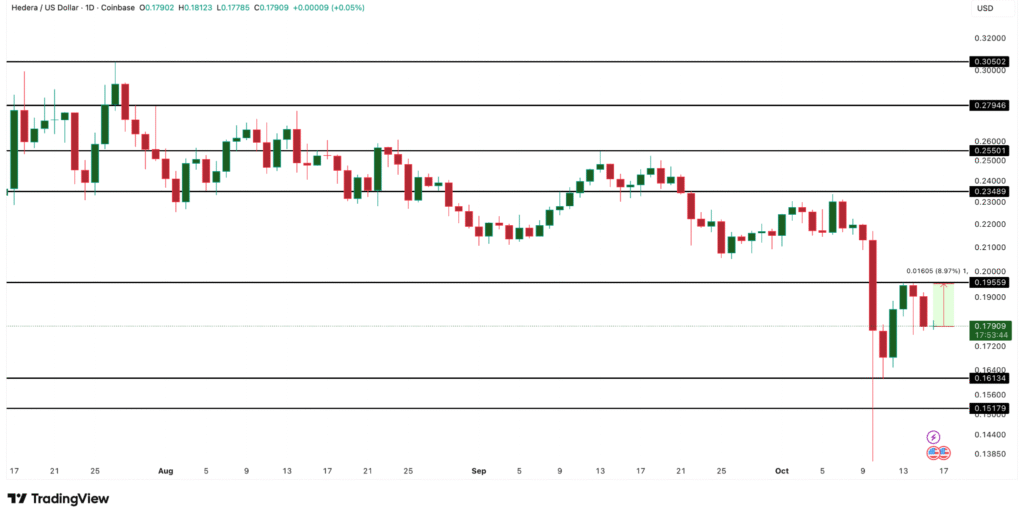

Hedera’s native token, HBAR, has faced significant downward pressure, with its price declining by 9.76% over the past 24 hours. This has put the cryptocurrency’s price near a critical support zone at $0.160.

Recent price action suggests that a key price level needs to hold for HBAR to avoid further downside. If the price breaks below $0.160, further declines are anticipated toward the $0.155 to $0.150 range.

However, if the support zone holds, a potential rebound toward $0.170 to $0.175 may occur, contingent on renewed buying interest.

Momentum Indicators Point Toward Possible Reversal

Despite the recent downtrend, several technical indicators suggest that the current sell-off may be nearing its end. The Relative Strength Index (RSI) has formed a bullish divergence, indicating that while the price has continued to make lower lows, the momentum is weakening. This divergence typically signals that sellers are losing control and that a trend reversal could be on the horizon.

Additionally, the Chaikin Money Flow (CMF) remains positive at 0.18, although it has eased slightly in the last two days. The CMF measures the flow of money into or out of an asset and can be used to assess the strength of a price move.

The positive CMF suggests that larger wallets are still accumulating HBAR, which may provide a foundation for a reversal if buying pressure picks up. However, if the CMF falls below 0.14, it could signal that the buying interest is drying up, weakening the bullish outlook.

HBAR Needs a 9% Break Above $0.19 for Bullish Confirmation

For HBAR to confirm a potential trend reversal, it must overcome a significant resistance zone around $0.19. This price level has acted as a ceiling in recent days, preventing any upward movement.

A sustained break above $0.19 would indicate that buyers have absorbed the sell pressure and are now in control, paving the way for further gains. In that case, the next resistance levels would be at $0.23 and $0.25, marking previous highs.

On the other hand, if HBAR fails to hold above its current support near $0.16, it could continue to struggle, with a potential slide toward the $0.15 region. At this stage, the price action is at a critical juncture. A decisive move above $0.19 will likely determine whether HBAR begins a new uptrend or if the current bearish trend persists.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.