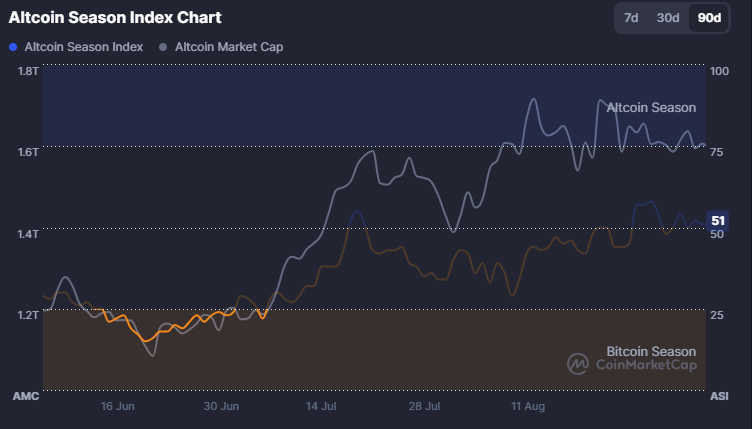

- Repeating Cycles: Altcoins had an obvious accumulation-to-rally Cycle in 2016/2017 and 2020/2021, both resulting in a sharp gain.

- 20242025 Setups The recent periods are the same as previous periods of consolidation which may imply another possible breakout in this cycle.

- Macro Drivers: Bitcoin halving events and liquidity cycles continue to reinforce structural similarities across altcoin market history.

Altcoins moved in clear phases during the 2016/2017 period, with prices consolidating before sharp upward rallies began. Market data reflected extended accumulation stages that created strong foundations for future growth. Consequently, these periods marked the beginning of significant capital inflows into alternative digital assets.

The 2020/2021 cycle demonstrated a similar structure, where sideways consolidation preceded explosive growth across the sector. Charts revealed repeating accumulation zones that mirrored previous phases. Therefore, many analysts compared the pattern with the earlier cycle.

During both periods, structural similarities strengthened the case for repeating trends within altcoin markets. Data showed how accumulation created platforms for expansion. As a result, each rally reached higher valuations than the previous cycle.

Current Market Phase

The 2024–2025 period now exhibits conditions resembling the earlier cycles. Charts illustrate another accumulation stage developing within broader consolidation zones. Thus, comparisons continue to highlight a possible breakout phase ahead.

Source: Coinmarketcap

Analysts note that market behavior aligns with earlier formations, where prolonged stagnation preceded stronger rallies. The structure provides a recurring theme in altcoin history. Hence, many view this phase as an echo of prior movements.

This projection suggests an ongoing build-up that may trigger higher valuations. Patterns indicate potential for a breakout consistent with historical cycles. Accordingly, market participants anticipate possible expansion if these signals hold true.

Narrative and Outlook

The recurring formations highlight the cyclical nature of altcoin markets. Charts outline consistent sequences of consolidation followed by rapid growth phases. Therefore, the narrative emphasizes structural reliability across cycles.

Underlying factors also shape these outcomes, including Bitcoin halving events and broader liquidity cycles. These drivers often reinforce repeating market structures. Consequently, altcoins tend to follow synchronized movements with major shifts in digital assets.

The outlook points toward higher levels if these conditions continue. Current consolidation reflects the build-up observed in past phases. Thus, expectations remain that altcoin markets may see expansion during the 2024–2025 window.

Disclaimer: The information in this press release is for informational purposes only and should not be considered financial, investment, or legal advice. Coin Crypto News does not guarantee the accuracy or reliability of the content. Readers should conduct their own research before making any decisions.