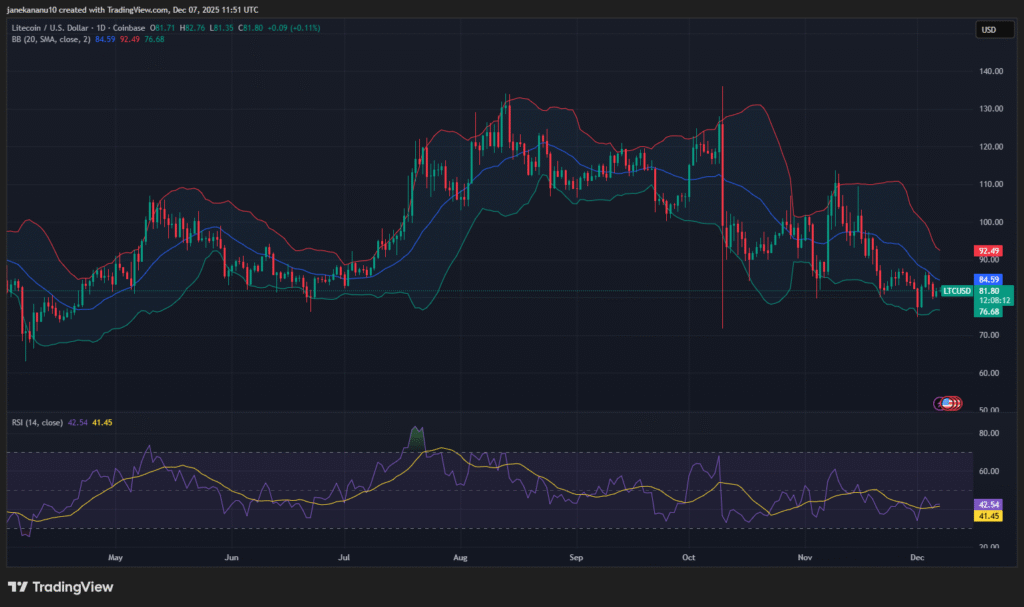

- Litecoin price reaches $81.80, showing a 0.11% increase with resistance at $92.

- The RSI for Litecoin stands at 42.54, showing a balanced market state.

- Futures data suggests a possible price surge as Litecoin nears key resistance.

Litecoin is showing slight gains as it hovers around $81.80. With resistance looming near $92, traders are closely watching for potential price movements. The upcoming days could determine whether Litecoin will break past key resistance or face a pullback.

Litecoin Price Analysis: Modest Gains and Key Resistance at $92

Litecoin (LTC) continues to show slight gains with its price at $81.80. This represents a modest increase of 0.11%. However, the price is still below the upper Bollinger Band of $92.49, suggesting that resistance may limit any immediate upward movement.

The Relative Strength Index (RSI) for Litecoin stands at 42.54, which suggests a neutral market. The RSI is not in the overbought or oversold range, indicating that the market is in a balanced state.

This creates an environment where Litecoin could experience fluctuations in price, but is unlikely to see extreme changes in the near term.

Key Resistance and Support Levels Shaping Litecoin’s Short-Term Outlook

Flowstate Trading, a reputable crypto analyst, has shared a positive outlook for Litecoin. According to the analyst, LTC is poised to break past the $90 resistance level and head toward $100.

Flowstate suggests that with strong support at $85.10, Litecoin has the potential to gain momentum if it can overcome the current resistance zone.

In line with this outlook, the data from Coinglass on Litecoin futures open interest shows a strong correlation between increased interest and volatility. Futures open interest surged significantly during mid-2023, peaking alongside price spikes.

The market remains cautious as Litecoin faces resistance at key levels. However, the technical indicators suggest that a break above $84 could lead to further upward movement.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.