- Litecoin LTC shows strong support between $41 and $51 for buyers.

- LTC technical setup signals potential rally toward $100, $300, $500.

- Resistance levels at $82, $140, and $270 may guide upward movement.

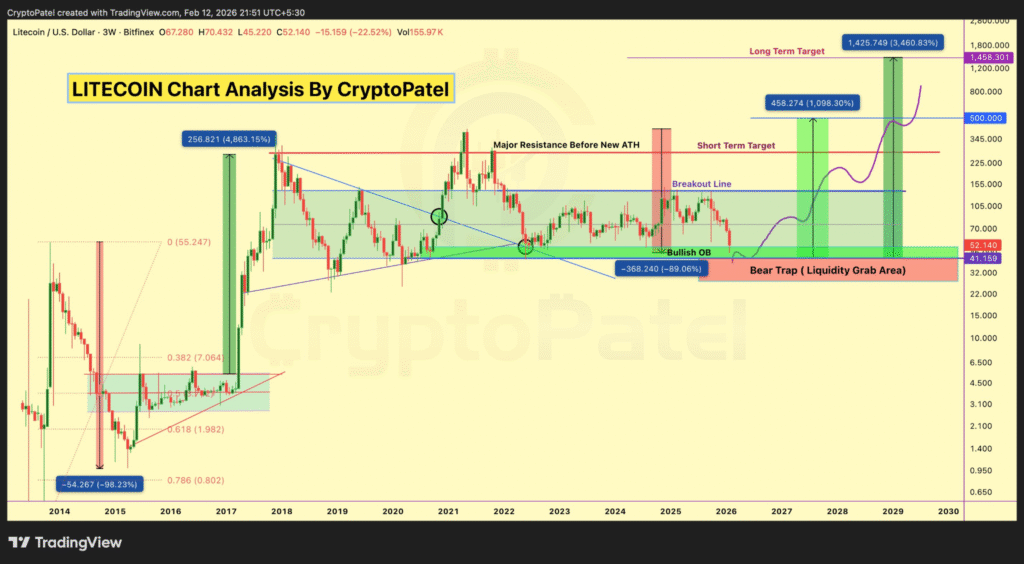

Litecoin (LTC) is showing signs of a possible major upside move after dropping nearly 89% from its all-time high. Technical analysis points to key support and resistance levels where bullish activity could emerge.

Litecoin LTC Approaches Key Support Zone After Large Drawdown

According to Crypto Patel, Litecoin LTC has fallen approximately 89% from its cycle all-time high. Technical charts show a macro inflection zone where past bull cycles began.

The zone between $41 and $51 is reinforced by a high-timeframe liquidity grab and bullish order block confluence. Analysts note that the structure remains valid above $40, which may prevent further decline.

A bear trap is identified near $42–$32, suggesting traders could be misled by short-term dips. Crypto Patel commented, “Support in this zone aligns with prior cycle bottoms and key liquidity areas.” LTC’s technical setup indicates that buyers may enter around these levels.

Resistance Levels and Upside Targets for LTC

Litecoin faces key resistance at $82, $140, and $270, with a breakout above $140 confirming trend expansion. If buying pressure strengthens, LTC could target higher levels. Analysts estimate potential upside at $100, $300, $500, and over $1,000 based on chart patterns.

The setup follows months of downward pressure, with LTC finding a technical base in its current range. Crypto Patel noted, “The bullish confluence at the $41–$51 zone may trigger accumulation, setting stage for higher targets.” Traders may watch these levels closely as a possible starting point for trend expansion.

Technical indicators show that LTC’s current price action could lead to a shift in momentum. If the market reacts positively, Litecoin may test the resistance points outlined above.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.