- Analyst says Pendle must hold $4.40 support to aim for $7 channel target.

- Pendle Finance TVL rose to $11.3B, reflecting 250 percent growth since May.

- Ethereum, Hyperliquid, and BNB Chain are leading Pendle’s cross-chain adoption.

Pendle ($PENDLE) is facing a critical test at a key support level while its ecosystem expands rapidly. Analysts are pointing to $4.40 as the price that must hold for the token to attempt higher moves.

Meanwhile, new data shows Pendle Finance has reached a record in total value locked. The developments combine technical and ecosystem growth factors shaping the protocol’s next stage.

Price Channel and Analyst Projections

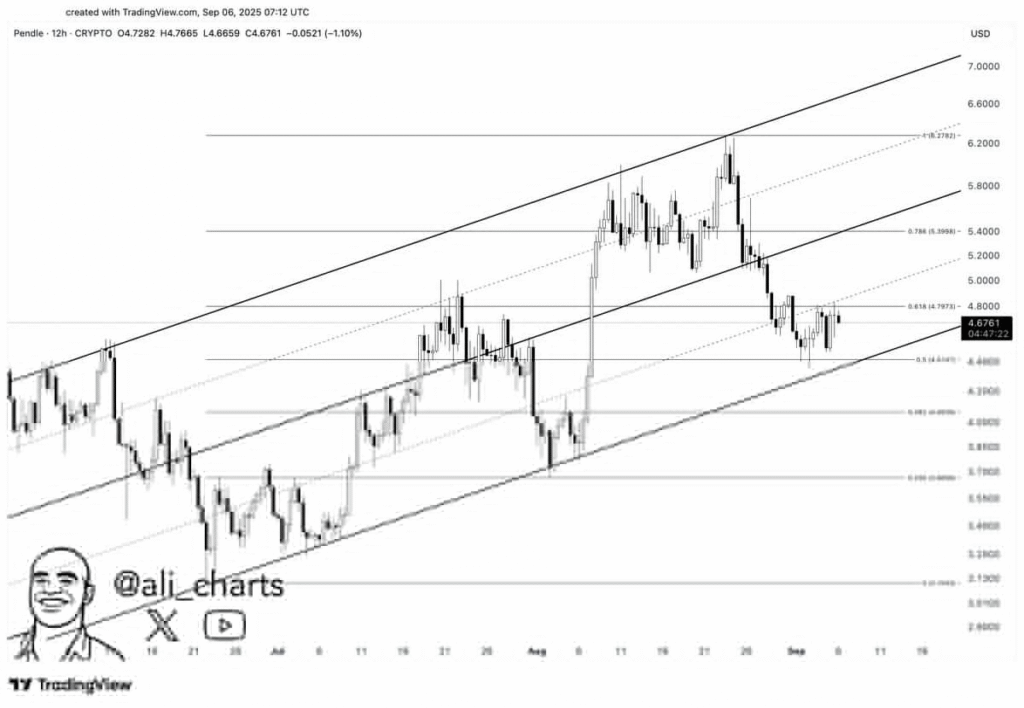

Crypto analyst Ali Martinez has stressed that traders should watch $4.40. He explained through a TradingView chart that Pendle has been moving inside a rising parallel channel since mid-June. The token tested the lower boundary of the channel around $4.40 before starting an attempted recovery.

Martinez reported that Fibonacci retracement levels place resistance near $4.80 and $5.20. He warned that losing $4.40 could expose Pendle to a decline toward $3.80. “$4.40 remains the support that must hold to pave the way for a rally,” he said.

Holding this level could allow the token to target $7 in the current structure. The next movement will depend on whether the support level is maintained. The $4.80 and $5.20 zones remain short-term resistance checkpoints for bullish continuation.

Pendle Finance TVL Growth

While technical signals drive attention, Pendle Finance has achieved a new milestone in decentralized finance. Data from Token Terminal shows that total value locked in the protocol has reached $11.3 billion. This marks a 250 percent increase since May, reflecting rapid ecosystem growth.

The TVL distribution confirms Ethereum, Hyperliquid, and BNB Chain as the top three networks driving liquidity. Additional contributions are coming from Arbitrum, Base, Berachain, HyperEVM, and Sonic. This cross-chain adoption shows Pendle’s broadening footprint across multiple ecosystems.

Pendle’s yield tokenization model allows users to trade and manage future yields more efficiently. The rise in liquidity signals growing use of this approach across several networks. With rising TVL and a key support test in play, Pendle remains focused on both traders and decentralized finance participants.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.