Ethereum’s Q1 2025 dropped over 6%, marking historic lows. Legal victory with Tornado Cash could…

Solana’s Struggles Continue as Q1 Losses Raise Concerns for Q2

- Solana tests key support levels, with further downside risks looming.

- Weak demand and low institutional interest are hindering Solana’s recovery.

Solana’s 2025 started with a real thud. In the first quarter, the asset plummeted by 34%, wiping out $100 billion of its market capitalization. Suddenly, Solana is back at the levels we saw last September. That’s left investors wondering if it can ever regain its footing. As the broader cryptocurrency market grapples with economic pressures and internal network struggles, one question remains: Can Solana turn things around in Q2, or will it keep sliding?

Market Sentiment Hits Rock Bottom

Solana’s Q1 decline was primarily driven by economic factors and the network’s internal struggles. Look at that 1D price chart: there aren’t any precise support levels, which means further declines are possible. Only about a third of Solana’s circulating supply is in profit, which, combined with a decrease in market optimism, makes Solana particularly vulnerable to further corrections.

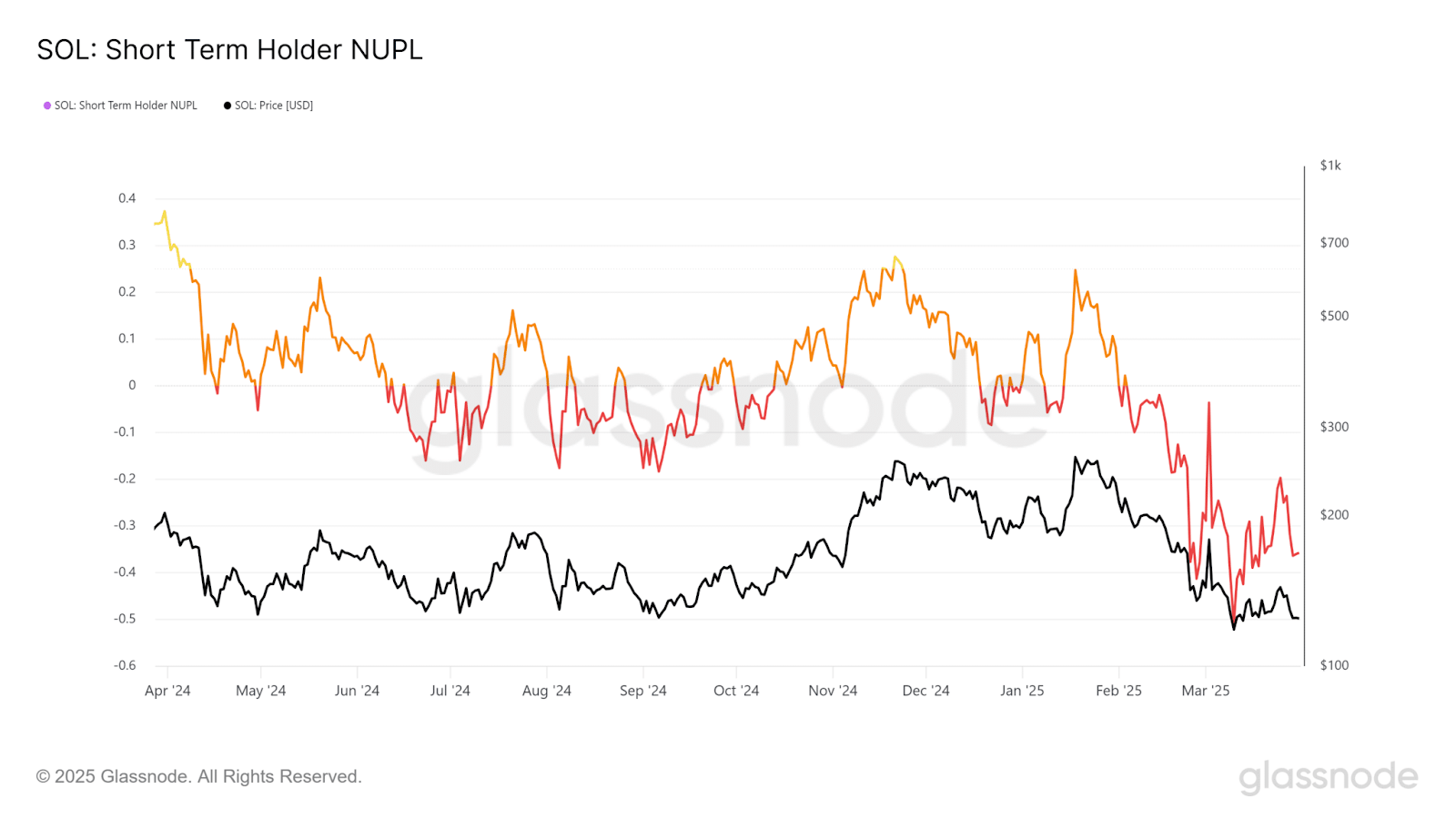

Source: Glassnode

Glassnode’s Net Unrealized Profit and Loss metric shows that short-term holders have reached the point of no return, and they’re trying to cut their losses. If the market doesn’t recover quickly, Solana could face a liquidity crisis, which could make the negative price action even worse.

Solana Faces Crucial Support Levels in Q2

Solana is testing support at $120.66 and resistance at $147.88. The price is at $124 and uncertain. Technicals like MACD suggest a bearish flip, which could push the price down to lower support levels, including $115.

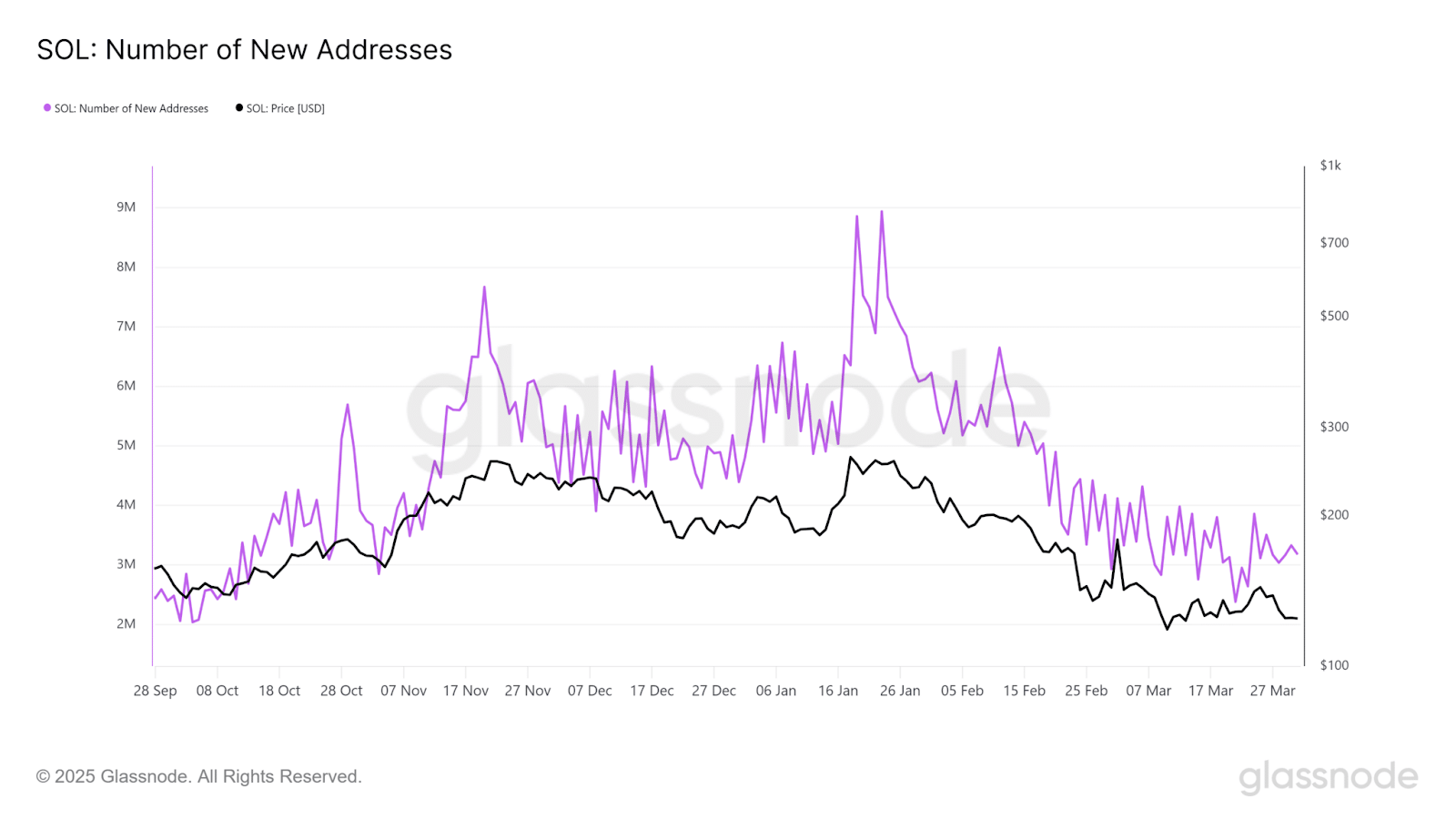

New address growth has dropped to 312,000, its lowest in 6 months, from 8 million at the beginning of Q1. This decline in new user adoption is weak, and combined with decreased staking and DEX activity, Solana’s Q2 looks bleak.

Solana Key Support Levels and Market Sentiment

According to Capsey’s analysis on trading view, as of April 1, 2025, Solana is at $127.20, testing support at $120.66. Resistance is at $147.88, and the RSI is 43.28, which is neutral, neither overbought nor oversold. MACD is about to flip bearish, which means the price could go down to lower support levels. The price is making lower highs, so unless a reversal happens, the bearish trend will continue.

Recently, Coincryptonews reported that Solana’s future market is also struggling. CME’s recent launch of Solana futures didn’t attract much institutional interest, with only $12 million in volume on its first day. This is a sign of Solana’s struggle to attract institutional money. While Bitcoin and Ethereum futures are dominating the market, Solana’s lack of momentum in this area reflects its limited appeal in the broader market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.