- A $16 dip in Chainlink ($LINK) could trigger a breakout to $100, per@ali_charts’ analysis.

- Symmetrical triangle pattern suggests a 525% potential surge from current $22.34 price.

- Institutional partnerships and DeFi growth may fuel the bullish outlook.

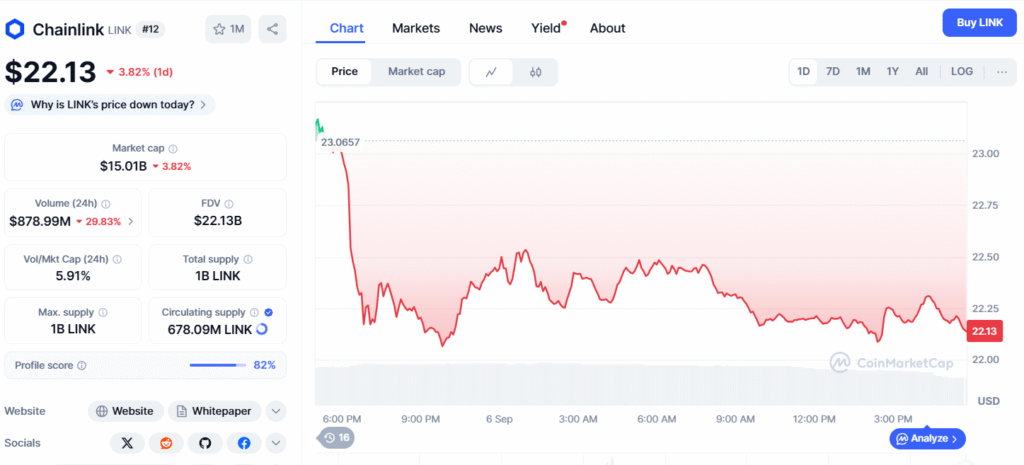

As the crypto market continues to evolve, Chainlink ($LINK) is making headlines with a bold price prediction from X analyst @ali_charts.

Posted on September 6, 2025, the analysis suggests a potential dip to $16 could set the stage for a dramatic breakout to $100, fueled by a symmetrical triangle pattern on the chart. This technical formation, known for signaling significant price movements, has sparked excitement among traders, with the current price of $22.34 offering a 27% drop scenario. If realized, the subsequent 525% surge to $100 would mark a historic rally, aligning with Chainlink’s past 340% growth cycles.

The prediction diverges from more conservative forecasts, such as blockchain news’ $24.59 target for 2025, reflecting a split in analyst sentiment. However, the long-term upward trend since 2023, combined with Chainlink’s role in DeFi and recent institutional partnerships (noted in a Onesafe.io report from August 2025), supports the bullish case. A retest of $16 could act as a “gift in disguise,” as some X users suggest, especially if staking or oracle narrative developments catalyze adoption. The $15.1 billion market cap provides a solid foundation, but such volatility hinges on market conditions and confirmation via volume indicators, a critical factor in validating symmetrical triangle breakouts.

While skepticism exists—some X replies doubt the $100 target—Chainlink’s ecosystem strength, including its all-time high of $52.88 in May 2021, keeps the “LINK Marines” optimistic. Investors should approach with caution, using stop-losses to mitigate false breakout risks, a common pitfall in this pattern. As DeFi grows and Web3 adoption accelerates, Chainlink’s potential to bridge smart contracts with real-world data could drive this ambitious forecast. For now, the crypto community watches closely, with the next few weeks potentially defining $LINK’s trajectory.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.