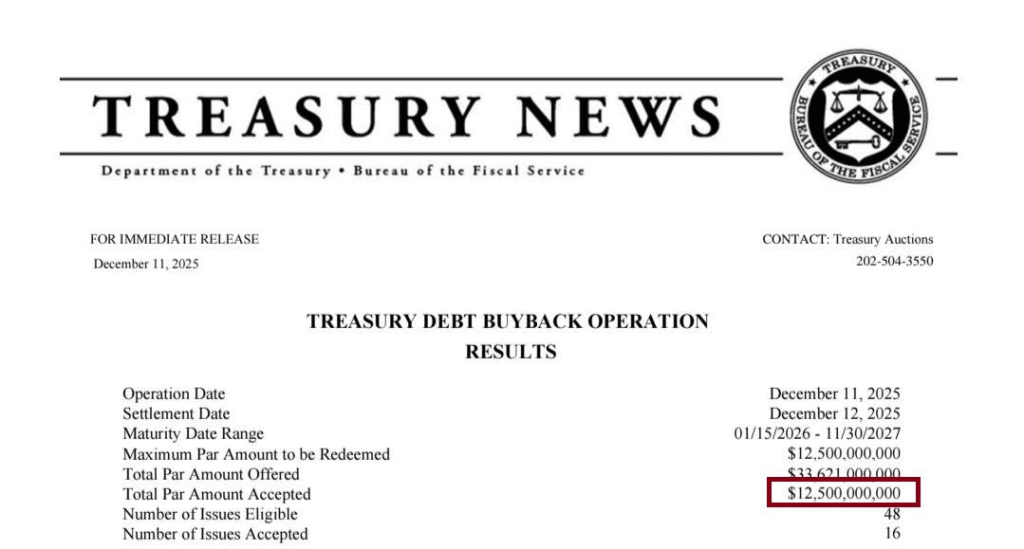

- The U.S. Treasury retired $12.5 billion in bonds using freshly printed dollars.

- $12.5 billion buyback adds liquidity, likely impacting risk assets like Bitcoin.

- Rising national debt grows as the U.S. Treasury conducts frequent debt buybacks.

The U.S. Treasury has completed its second massive debt buyback within a week, retiring $12.5 billion in bonds. This move follows the largest-ever debt buyback in U.S. history, completed just days prior.

Both buybacks were funded by freshly issued dollars. The Treasury’s actions aim to manage the country’s mounting national debt, which currently exceeds $35 trillion.

The bond repurchases, though aimed at providing short-term relief, are also fueling concerns about the long-term health of the U.S. economy.

Monetary Stress and the Rising National Debt

The Treasury’s buyback actions come at a time of increasing national debt. With over $35 trillion in outstanding liabilities, the U.S. is facing a growing challenge in managing its finances.

The decision to retire bonds with freshly printed money raises important questions about the sustainability of this approach. While these interventions help reduce the immediate burden of debt servicing, they add liquidity to the financial system, which can potentially spark inflationary pressures.

Critics argue that such actions reflect underlying stress within the U.S. monetary system. The debt buybacks, while providing temporary liquidity, could lead to long-term economic instability.

Freshly printed money can exacerbate inflation, devalue the dollar, and increase borrowing costs in the future. As the national debt continues to climb, some economists warn that this pattern of debt buybacks may not be sustainable in the long run.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.