- Over 94,000 BTC were moved to exchanges at a loss in one day.

- Bitcoin dropped below $65,000 during the largest short-term sell-off.

- Chart signals peak short-term capitulation behavior during correction phase.

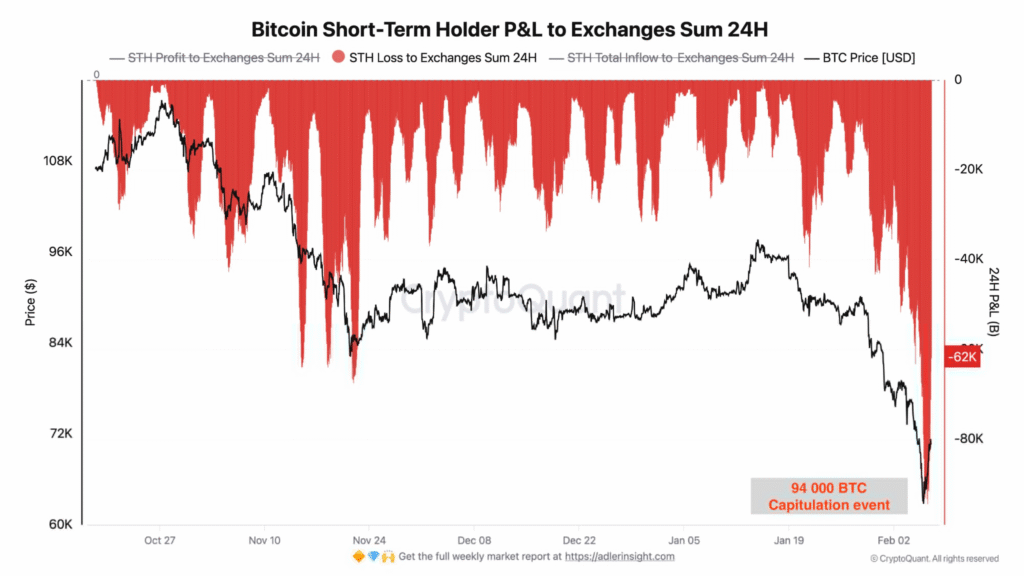

Bitcoin short-term holders have made their largest move to exchanges since the correction began, signaling a capitulation event. On February 7, over 94,000 BTC were sent to exchanges at a loss, as panic intensified when Bitcoin dropped below $65,000. This level of daily outflow marks a notable shift in short-term sentiment.

Short-Term Bitcoin Holders Move 94K BTC Amid Rising Sell Pressure

On February 7, short-term Bitcoin holders sent over 94,000 BTC to exchanges within 24 hours. This marked the highest single-day transfer by this group during the ongoing correction. According to Darkfost_Coc and CryptoQuant data, the total amount moved reflects roughly $6 billion in value.

The move occurred as Bitcoin’s price broke below the $65,000 level, triggering increased panic among unseasoned participants. When short-term holders move coins to exchanges, it typically suggests an intent to sell. In this case, the transfer happened at a loss, emphasizing the capitulation element. The chart shows an extreme spike in the red zone, representing loss-based inflows.

The behavioral pattern suggests many recent buyers exited their positions emotionally. The sustained downtrend pressured holders who entered the market at higher levels. As prices fell, losses widened, prompting mass exchange activity. This flow increase is often associated with local bottoms, though no reversal is confirmed.

Capitulation Data Confirms Largest Panic Move in Current Correction

This event marks the most substantial loss-driven activity among short-term holders since the current correction began. The metric used, Short-Term Holder Profit and Loss (STH P&L) to Exchanges Sum 24H, visualized a -62K BTC loss signal at its peak.

Historical data suggests that when large numbers of short-term coins are sold at a loss, a shift in market structure can follow. However, traders remain cautious, as similar behavior has occurred without price recovery. The capitulation narrative may shape near-term expectations, especially if exchange inflows remain high.

Emotional exits often define the end of phases in Bitcoin cycles. The market continues watching for stabilization or further downside, depending on macro and crypto-specific factors.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.