- Bitcoin’s RUL stays below 5% since November 2023, showing sustained growth.

- BTC reclaims $111k after testing $106,453 support, signaling early recovery.

- RSI and MACD turn bullish as Bitcoin targets resistance near $115,137.

Bitcoin’s Relative Unrealized Loss remains below 5%, a level not seen for long stretches in previous market cycles. This metric measures the dollar value of coins held at a loss relative to total market capitalization. Analysts see this as an indicator of investor confidence and low panic selling.

Since November 2023, the metric has stayed at these low levels, showing reduced unrealized losses during market fluctuations. Such sustained structure suggests that market participants continue holding their assets, expecting higher prices in the coming months.

Technical Indicators Point to Short-Term Recovery

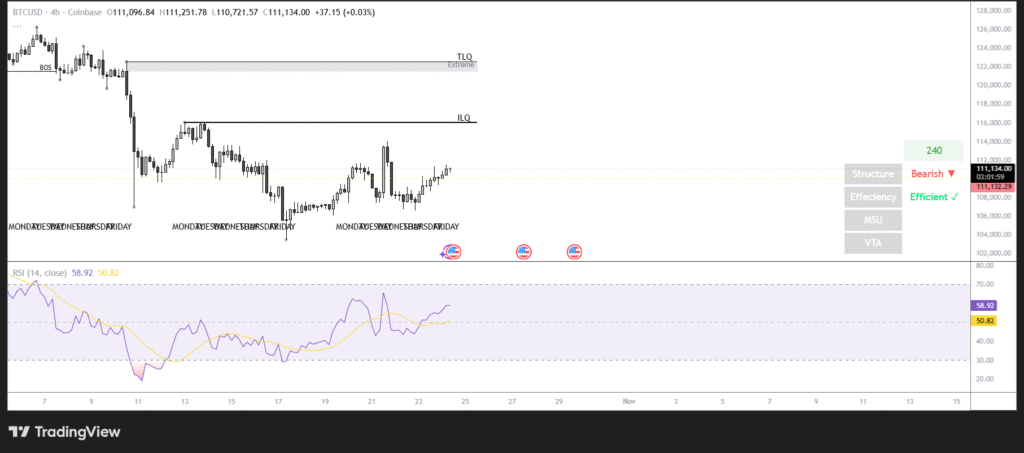

The BTC/USD 4-hour chart remains efficient but shows improving signals of recovery. Bitcoin rose 1% in the past 24 hours and now trades above $111,000. The price earlier faced resistance from the 50-day Exponential Moving Average (EMA) at $113,329 but managed to regain strength after testing support near $106,453.

The Relative Strength Index (RSI) stands at 58, suggesting increasing buying pressure. Analysts say the RSI must remain above 50 to confirm a continued rally. The Moving Average Convergence Divergence (MACD) indicator also indicates a bullish crossover, suggesting a near-term upward movement.

Bitcoin Price Outlook Toward $115k Resistance

If the bullish momentum continues, Bitcoin may move toward the next resistance at $113,329 and potentially $115,137. A sustained close above these levels could extend the current rally.

However, a daily close below $106,453 could trigger a retest of the $102,000 swing low from October 10. Traders continue monitoring whether the momentum holds as Bitcoin maintains its upward bias supported by the low RUL metric.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.