- Analysts predict Bitcoin’s price may drop below the critical $108K level.

- Bitcoin faces strong resistance, signaling potential for further price declines.

- Key support zones at $108K and $104K will determine BTC’s next move.

Bitcoin’s price action on the 4-hour chart shows signs of sideways consolidation, suggesting that the cryptocurrency may soon face greater volatility. This period of consolidation typically signals the market’s preparation for a larger price movement.

According to DustyBC Crypto’s recent analysis, Bitcoin’s likely direction is bearish, with potential targets around $108K. The cryptocurrency has struggled to maintain upward momentum, particularly within key resistance zones, before a sharp downward movement.

Resistance Levels and Bearish Sentiment

Bitcoin recently surged but encountered significant resistance, particularly in a major supply zone. This resistance led to a sharp price drop, supporting earlier predictions that BTC would fail to hold above higher resistance levels.

Analysts believe that after testing these higher zones, Bitcoin is likely to continue its downward trend. As the price moves toward key support areas, traders anticipate a minor price reaction before further downside movement.

The overall sentiment suggests that Bitcoin may struggle to hold its ground, with further declines expected unless it can hold above critical support levels.

Key Support Zones and On-Chain Insights

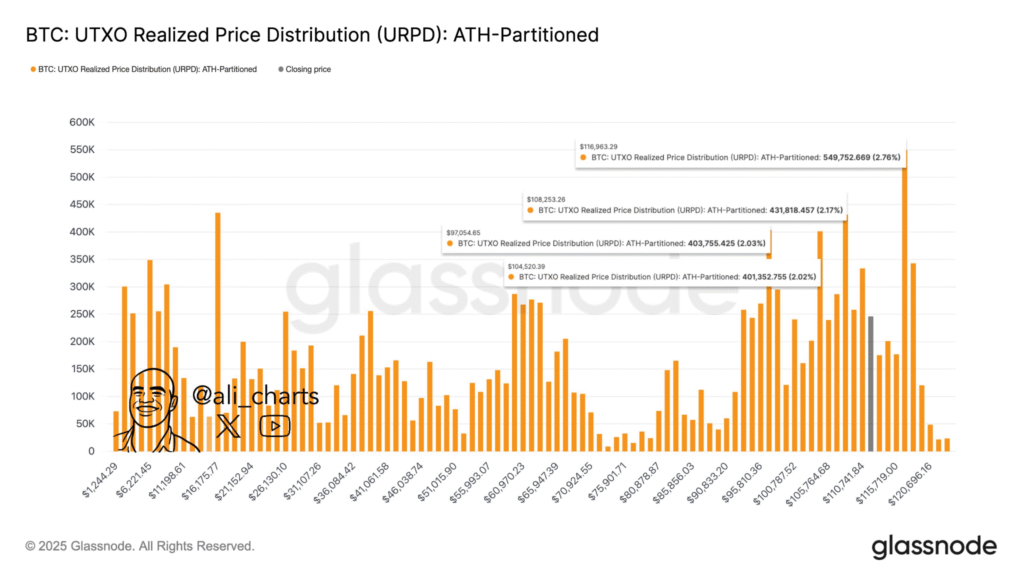

Meanwhile, Glassnode’s data on Bitcoin’s UTXO Realized Price Distribution (URPD) highlights critical support levels that traders should monitor. Analyst Ali Martinez identified key price points where significant amounts of Bitcoin were previously transacted.

The $108,250, $104,520, and $97,050 levels are crucial as they mark areas with heavy investor positioning. These levels are considered potential floors for Bitcoin’s price if the market experiences further downside pressure. If Bitcoin fails to hold above these areas, it could trigger deeper corrections, signaling more bearish price action.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.