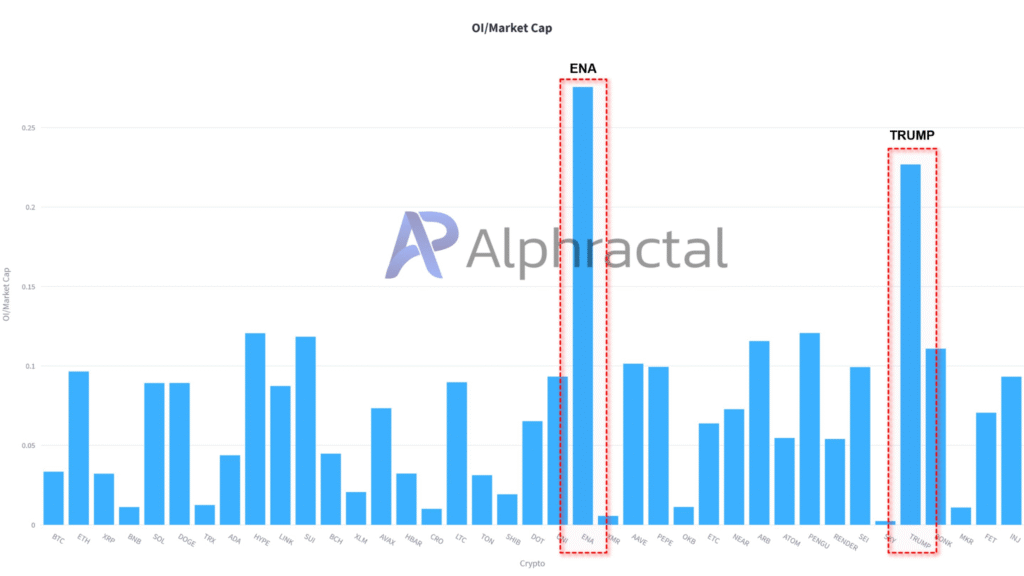

- ENA and TRUMP show high leverage with rising Open Interest to Market Cap ratios.

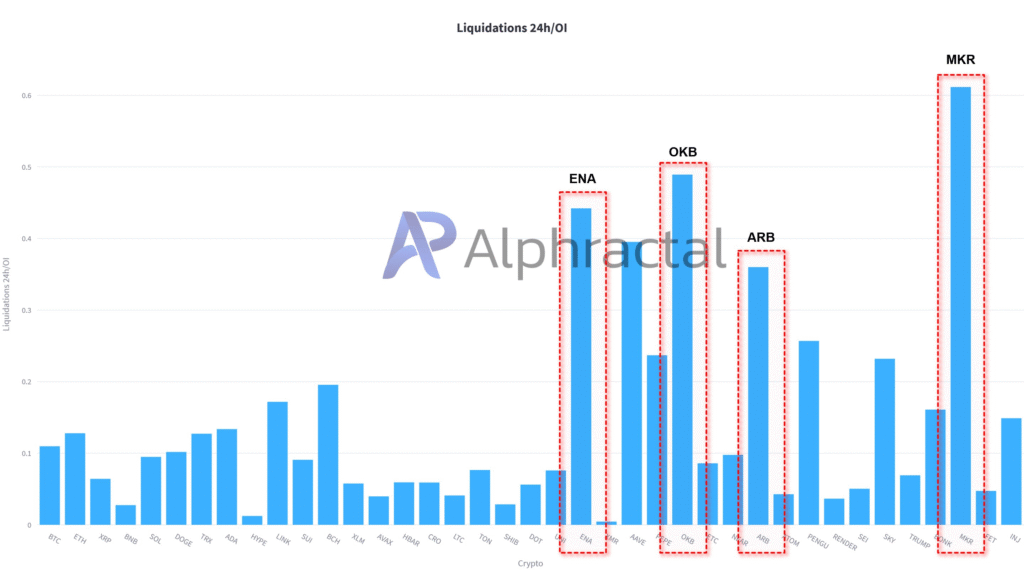

- MKR shows sharp spikes in liquidation, signaling strain in leveraged positions.

- The Altcoin Season Index reaches 88, marking a strong shift away from Bitcoin.

The altcoin market is currently experiencing heightened risk due to rising leverage, with specific tokens like ENA and TRUMP standing out. Alphractal data shows that these tokens have the highest Open Interest (OI) to Market Cap ratios, indicating an aggressive trend of traders taking on more leveraged positions.

This surge in leverage suggests growing speculation within the altcoin market, raising concerns over its stability. As traders increasingly open leveraged positions, the market could face increased volatility, making risk management crucial for participants.

Rising Liquidations Indicate Market Fragility

Along with the elevated leverage, several altcoins are showing significant 24-hour Liquidations to Open Interest (OI) ratios. Tokens like ENA, OKB, ARB, and MKR are recording the highest liquidation ratios, signaling forced position closures.

These forced liquidations can lead to rapid price movements, further contributing to market instability. MKR, in particular, has shown the sharpest increase in liquidation ratios, suggesting that leveraged positions are under growing strain.

This trend is worrying, as it points to a fragile market structure, where sudden price shifts could trigger cascading sell-offs.

September Marks Altcoin Season with a Shift in Market Focus

According to BlockchainCenter.net, September 2025 marked the start of Altcoin Month, a period characterized by a strong shift in market momentum away from Bitcoin. The Altcoin Season Index has surged to 88, surpassing the 75 threshold, which historically signifies the dominance of altcoins in the market.

This spike suggests that most of the top-performing cryptocurrencies are now outperforming Bitcoin. As a result, investors are focusing more on altcoins, driving up speculative interest and capital movement into these assets.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.