- Ethereum’s Q2 2025 performance shows signs of stabilization after sharp losses.

- Developers propose 4x gas limit increase ahead of crucial Fusaka upgrade.

Ethereum is facing a challenging start to 2025 following its worst first-quarter performance. Prices have dropped sharply, though some signs of stabilization are emerging in Q2. Market analysts point to upcoming network upgrades as a potential catalyst for recovery.

At the time of writing, Ethereum (ETH) is trading at $1,758, up 0.09% in the past 24 hours.

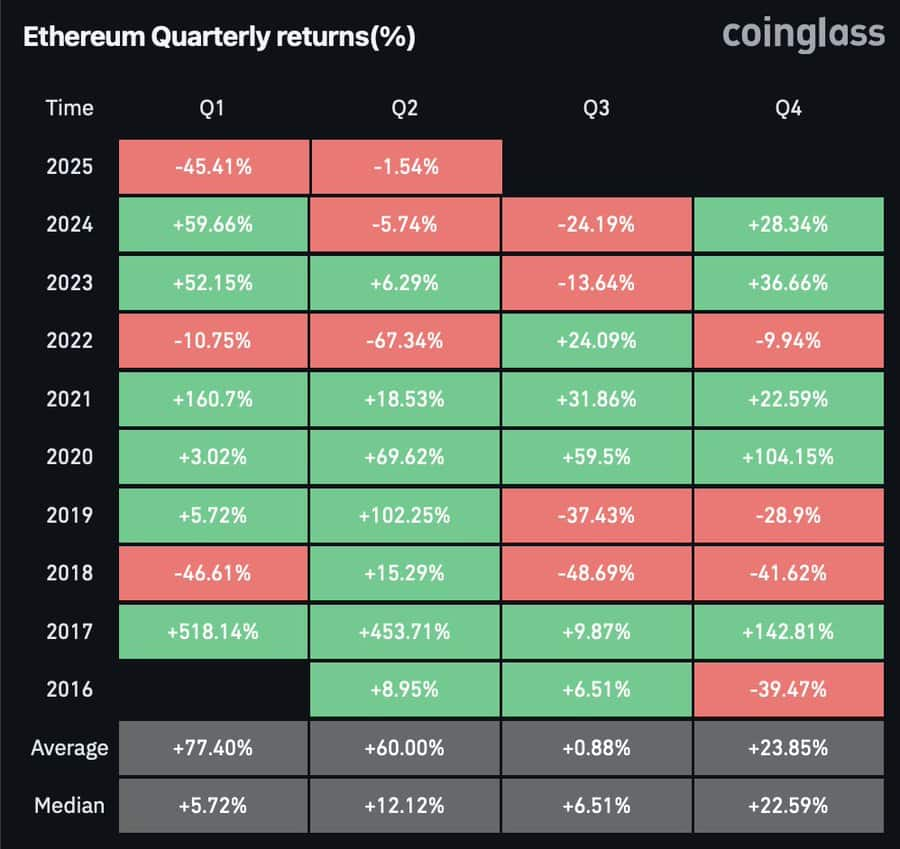

However, according to Coinglass, the cryptocurrency recorded a -45.41% return in Q1 2025, marking its weakest start since 2022. Analysts report that many buyers caught in the late 2024 “Trump pump” are now holding deep unrealized losses. By comparison, investors from Q1 2023 and 2024 saw major gains, with potential for investments to double within months.

CoinGlass data also indicates that Ethereum’s Q2 2025 performance has been more stable, with a modest 1.54% decline. Historical trends show Ethereum often rebounds in Q2, although exceptions occurred in 2022 and 2024 due to broader market struggles.

Analysts suggest that market sentiment today is less driven by hype and more by upcoming technical upgrades, providing a different backdrop than previous years.

Technical Charts Indicate Potential Breakout Ahead

Ethereum trades near $1,627.65 inside a descending channel. Technical analysts observe that ETH tests the channel’s upper boundary, hinting at a potential breakout. Tightening moving averages, as noted in recent trading reports, add weight to the bullish possibility.

Projections show that if Ethereum clears short-term resistance, targets could shift upward to $1,750 and beyond. Further resistance levels are mapped at $2,250 and $2,693.18, with longer-term hopes of a move toward $3,000. Immediate support sits around $1,603.30, a key zone to preserve the bullish structure.

Developers Prepare for Major Gas Limit Expansion

Ethereum developers are preparing a critical network upgrade before the Fusaka release in late 2025. In the recent All Core Devs Execution (ACDE) #210 call, lead analyst Tim Beiko outlined plans for a fourfold increase in the gas limit. The proposal, EIP-9678, suggests raising the limit from 36 million to 150 million to improve Layer 1 scaling.

Beiko emphasized that early testing and validator coordination are crucial for the transition. Over the coming months, developers are working to finalize the EOF (Ethereum Object Format) scope and adjust gas defaults.

If approved, the change could lower fees and increase transaction throughput, strengthening Ethereum’s network fundamentals. Observers note that while validator approval remains a hurdle, early community feedback has been cautiously optimistic.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.