- $5B Nasdaq Debut – American Bitcoin entered public markets with a $5 billion valuation and $260M in BTC holdings.

- Aggressive Growth Plans – The company announced a $2.1B fundraising push to expand mining operations and strengthen reserves.

- Political Spotlight – Led by the Trump brothers, American Bitcoin blends political influence with mainstream financial visibility.

American Bitcoin has officially entered Nasdaq, signaling a major move for the crypto industry. The company launched at a valuation of about $5 billion and reported holding Bitcoin worth almost 260 million dollars. It is listed as a combination of financial ambition and political figuration, and it preconditions the further development of the sphere.

$5B Debut and Fundraising Plans

The company completed its debut after merging with Gryphon Digital Mining. During its first session, the stock surged, nearly doubling before cooling. It ended the day up sixteen percent, showing strong demand from the market.

American Bitcoin announced immediate plans to raise $2.1 billion through new share offerings. The funds are intended for mining expansion, additional Bitcoin purchases, and broader growth. This bold fundraising highlights the company’s intention to scale rapidly in a competitive market.

The combination of strong valuation, fundraising, and large-scale Bitcoin holdings creates a unique position. The company is building momentum while linking digital assets with traditional markets. Its approach places both pressure and opportunity on its long-term strategy.

Bitcoin Market Context

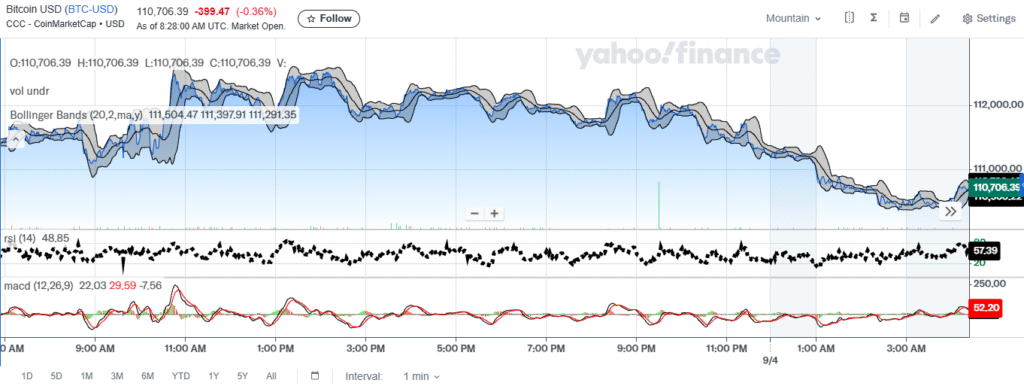

Bitcoin is currently trading at $110,706, down 0.36% during the latest session. The price slipped from recent highs near $112,000, moving closer to the lower Bollinger Band. This reflects weakness and an ongoing battle to maintain support levels.

Source: Yahoofinance

Momentum signals show mixed readings. The RSI stands at 48.8 which indicates a neutral but borders on oversold territory. MACD is negative, which indicates that the stock is under a bearish influence in the short run.

Trading volumes are kept down with small spikes when dipping intraday. Bitcoin could risk further losses until it rebounds over the next 111, 500. Any decline below the level of $110,000 would be a test of deeper support and any progression above the level of $112,000 would bring confidence back to the market in the short term.

Strategy and Outlook

American Bitcoin’s business model blends mining and treasury management. The company aims to produce Bitcoin, grow reserves, and buy during favorable conditions. This strategy positions it as both a miner and long-term holder of BTC.

The Trump brothers maintain strong control over the company, with additional backing from Hut 8. Their leadership keeps strategy tightly managed and under significant public attention. Political associations further increase visibility, creating both opportunities and scrutiny.

The Nasdaq debut creates new expectations for performance. With $2.1 billion fundraising plans underway, American Bitcoin must now deliver clear execution. Its future success will depend on sustaining momentum while navigating both market volatility and public spotlight.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.